Volatility Farming

Welcome! Today we will be exploring Apollo’s implementation of Volatility Farming. This is a pretty in depth article, so hold onto your hats.

Before diving in here, please check out our previous article to gain an overview of what we are building in relation to Volatility Farming: https://articles.apollo.farm/supercharging-lsd-yields-on-cosmos-part-ii-the-captain-of-sustainable-lsd-yields-2/

Volatility Farming Simplified

This article will dive into the depths of how Apollo will be executing upon our Volatility Farming vision, which may get a little technical, our goal is to make it as simple as possible for our users. We will therefore start off with a simple explanation of Volatility Farming and the benefits it will provide.

What is Volatility Farming?

When you deposit into an Apollo Vault, you receive a Vault Token (VT), think of this as a “receipt” of your deposit. This VT can then be paired with APOLLO, creating a liquid market for the VTs. This means that Apollo VTs have two values:

- Entry/Redeem Value

- Trading/Exchange Value

The difference between these two values creates arbitrage opportunities that can then be executed by users. Every time someone executes one of these arbs, Apollo earns fees (the majority of which are passed on the VT/APOLLO LPs). We will be diving into exactly how this works and how these opportunities are created later on, but for now if you take our word for it, we can begin to explore the benefits.

What are the benefits of Volatility Farming?

For our Users

- The ability to buy discounted LSDs

- The ability to arbitrage LSDs for a profit

- The ability to buy discounted APOLLO (with no taxes)

- The ability to trade between LSD VTs with no fees

- The ability to LP (LSD)VT/APOLLO for volatility induced yield

For Apollo

- More demand for APOLLO to pair with LSDs, combined with deflationary supply

- More volume flowing through APOLLO, increasing the burn and driving buybacks

- Increased liquidity depth for APOLLO markets

- Increased TVL in Apollo Vaults, leading to more fees

For LSD Providers

- Sustainable Yields for LSD LPs

- Increased LSD liquidity, making their LSD more liquid and attractive for DeFi

Overall there will be a range of benefits for both our users and Apollo, as well as LSD providers, but the key to attracting as many users as possible will be designing a simple and easy to use platform. Below is the full design of the Arb Page we are working towards. It will launch with slightly less functionality than the design below and will continue to be improved and developed over time, but even from launch it will enable users to quickly identify and execute arbitrage opportunities.

Our Volatility Farming will have two main Vault designs

- “Standard” Volatility Farming Vaults

- “Specialised” Volatility Farming Vaults

So far we have only released Specialised Vaults, which have conditions, such as the 7 day withdrawal period on our wstETH and wstETH/NTRN Vaults and the Capped entry to our stTIA Vault. While these have proved popular and we have been very pleased with their success so far, their specific conditions make arbitrage opportunities more complex. However we will soon be releasing our Standard Vaults, which is where our Volatility Farming will really come into full force.

First of all we will cover the design of our upcoming “Standard” Vaults, which will make the design choices of the “Specialised” Vaults more apparent.

Apollo’s “Standard” Volatility Farming Vaults

For Apollo’s “Standard” Design, we will utilise just a 2% Exit fee for the LSD Vaults (and no trading taxes), which has a number of benefits:

- It makes it much quicker and easier to deploy our Volatility Vaults, as we will no longer have to go through Astroport Governance to list each pool.

- Less overall taxes, reducing the volatility threshold for Arbitrage

- Is easier to enforce vs trading Tax and is more flexible.

- Higher % of fees to LPs

- Introduces APOLLO buy Pressure (45% of fees = APOLLO by pressure)

- Easier to deploy to new chains

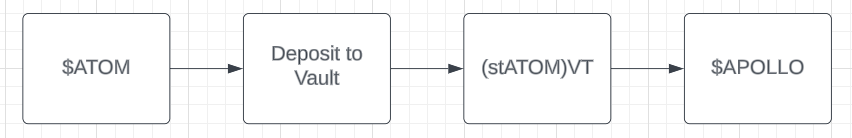

It also provides users with a new way to trade APOLLO. Either users can pay 3% in tax to buy through Astroport “Base” pools, or they can deposit funds into Apollo Vaults and swap VT to APOLLO for no tax.

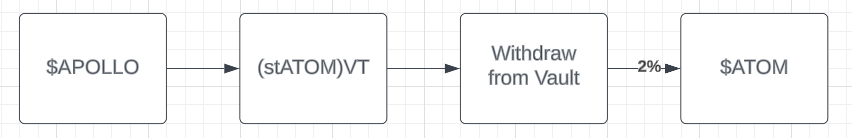

To Exit APOLLO users can either pay 3% in tax to sell through Astroport “Base” pools, or they can swap to Vault Token and pay 2% Exit fee.

Both of these paths benefit Apollo, and the best option for each user will depend on size, liquidity and prices. This will also create an interesting ecosystem of Apollo VTs, where users can trade between nearly all our different VTs with no fees.

Standard Volatility Vault Summary

Our Standard LSD Vault will have a 2% Exit Fee:

- 80% of the exit fee would incentivize the (LSD)VT/APOLLO Vault

- 20% split between burning APOLLO and the Apollo Development Fund.

Upcoming Volatility Vaults

Here is the current selection of some of the new Vaults that we are interested in releasing on Neutron, but is definitely not an exhaustive list (and some are yet to release an LSD). We are also keen to work with new/upcoming LSD providers, in order to increase the decentralisation of Liquid Staking on Cosmos.

Arbitrage Paths

Having looked at the design of these upcoming Vaults, we can begin to understand the different paths or Arbitrage that users can take and how fees will be generated.

Full Arbs

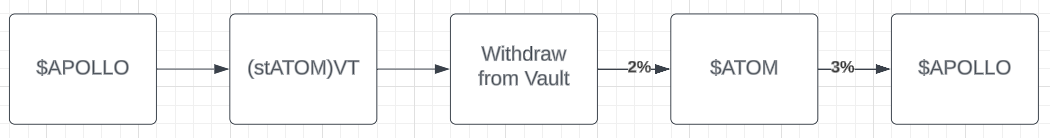

“Full Arbs” are where a user wants to increase their stack of either $APOLLO or the LSD token, such as $ATOM. They go from their chosen token, through the Vaults and end up with more of their chosen token (if successful).

Earn $APOLLO through Arbs = 5% fee, decrease in Vault TVL

- Can be executed if $APOLLO price goes down (on external markets)

- This increases VT price vs APOLLO and increases $APOLLO price vs $ATOM

- While LPing will remain the core use case of APOLLO, this will provide a way for users to earn a “yield on their APOLLO, by executing arbitrage opportunities.

Earn the LSD token ie: $ATOM through Arbs = 3% fee, increase in Vault TVL

- Can be executed if $APOLLO price goes up (on external markets)

- This decreases VT price vs APOLLO and decreases $APOLLO price vs $ATOM

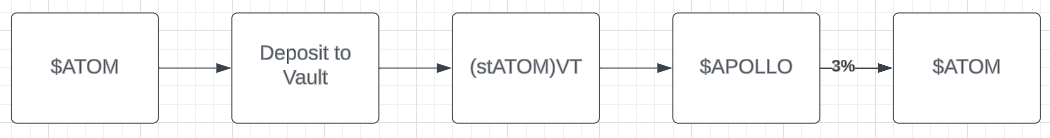

Half Arbs

“Half Arbs” will be a new way to buy or sell $APOLLO, with reduced fees. This will allow users to purchase $APOLLO with no fees or taxes (except DEX fee), however they will need to deposit liquidity into the Vaults. Whether this is more cost effective than trading through the main “Base” pools (with a 3% Tax), will depend on their Size and the available liquidity.

Buying $APOLLO = 0% fee, increase in Vault TVL

Selling $APOLLO = 2% fee, decrease in Vault TVL

Advantages of this Design

Overall there are a number of advantages which we have already covered, however the additional benefit is that users only pay fees when exiting the Apollo VT ecosystem. This means users can easily trade between our range of Vault Tokens and $APOLLO, while paying no fees.

Our longer term aim is to make Apollo’s Vault Tokens superior to their non yield earning counterparts. Not only will users be providing more benefits by ensuring deeper liquidity, but they will continually earn compounded yield. Main benefit for our LSD Vault Tokens will be composability.

Downsides of this design

The main “downside” of this current design is that all the rewards will be going to VT/APOLLO LPs, rather than just LSD Vault users. While this means that our LSD Vaults wont have boosted the yield (beyond increased fees from arb volumes), this will be the “Volatility Farming Bootstrapping Phase” and Apollo Governance (once launched) would reserve the right to change the future fee structure to make it more attractive the to LSD Vault (fees for Vaults that have already been deployed, fees can only be lowered or redirect, to raise fees new Vaults would have to be deployed).

Overall there are a number of strong benefits and we are excited to be releasing our new “Standard” Vaults soon.

- No reliance on Tax pools and Astroport Governance,

- More incentives to move through Arb pools, increasing volumes and therefore liquidity,

- 45% of fees go to buy pressure for APOLLO (as they are compounded into VT/APOLLO Vaults),

- Easier to calculate and execute arbitrage opportunities,

- Overall fees are more favourable to arbitrageurs, allowing smaller moves to be captured,

- Easier to deploy our Volatility Farming to new chains, such as Osmosis.

Specialist Volatility Farming Vaults

Our “Specialist” Volatility Farming Vaults (like our Locked wstETH, wstETH/NTRN and Capped TIA Vaults) will have a 3% trading fee between the (LSD)VT and APOLLO, with 100% of the Buy Tax going to the (LSD)VT/APOLLO LPs (and 100% Sell Tax burning Apollo).

While their design will prevent some arbitrage through the Vaults, they also open up unique opportunities:

1. Depending on their market price vs APOLLO, wstETH and wstETH/NTRN Vaults will allow:

- Users to buy ETH or wstETH/NTRN LP a discount, if they are willing to wait 7 days to unlock.

- Sell APOLLO at a premium, if they are willing to wait 7 days to unlock.

- Enter the Vaults for a Discount

- Exit immediately

2. Depending on TIA’s market price vs $APOLLO this Vault too creates some interesting opportunities:

- especially when combined with the future STRD airdrop.

- This was well explained by @fluffy_trex.

What this means in practice is that users that want to exit have a significant incentive to exit through the trading pool, rather than by withdrawing from the Vault. While there are likely not too many exiting this Vault at this time due to the long terms incentives to remain, it does create an interesting dynamic and will benefit the (stTIA/TIA)VT/APOLLO LPs once users begin to exit in the future.

As mentioned previously, utilising trading taxes is not as efficient and has some downsides compared to just using exit fees, however, for specific Vaults, its +VE to maximise the amount of TVL in the LSD Vaults due to the high APRs (meaning higher performance fees). It therefore makes sense to minimise fees on the LSD Vault and to utilise trading taxes on the VT/APOLLO pools.

However, for future Vaults, the real value comes from maximising the amount of TVL in the VT/APOLLO Vaults, and we also want to avoid having to go through governance to list too many tax pools.

Conclusion

Thanks to everyone who made it all the way through. We will be breaking down some of the concepts in here over the coming weeks as we release these Vaults, but we believe this gives a good overview of our plans for our Volatility Farming release.

We will begin to roll out new Vaults over the coming weeks and will speed up deployment of new Vaults and strategies into next Quarter. We have also been in contact with some teams to bring new LSDs to Neutron.

Overall the key benefits for Apollo will include constant $APOLLO buy pressure as due to the volatility for the crypto market. Combined with the limited and deflationary $APOLLO supply, as we release more VT/APOLLO Vaults the competition for $APOLLO will increase, which in turn will increase the yields for our volatility farmers, driving up the demand for $APOLLO.

We have spent the last couple of weeks tweaking and improving Apollo, especially in regards to speed and handling of data/stats on the Apollo backend. These improvements will pay dividends in the longer term as we continue to add new Vaults, specifically in relation to our Volatility Farming, which will be coming very soon.