Apollo DAO Roadmap and Development Insight.

Welcome to the first instalment of the Apollo DAO development update. This will be the first post of an ongoing series aimed at providing more insight and clarity into what the Apollo team is working on, why we are working on it and how it fits into our longer term vision.

This first Dev insight post will be more in depth as it will cover our overall roadmap and will be used as a reference point for this ongoing series, with shorter weekly updates and more detailed monthly updates to follow.

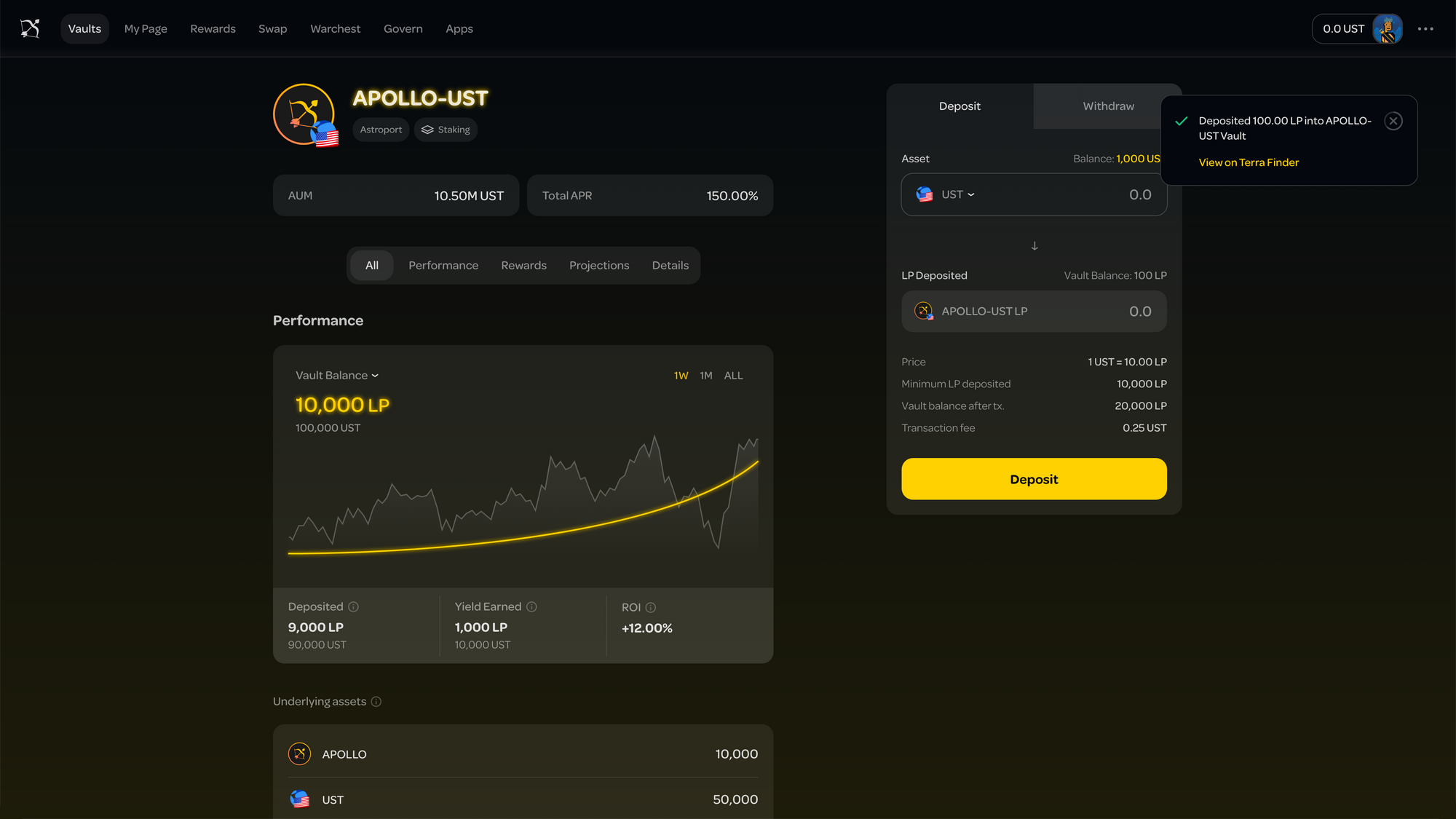

1. Apollo Staking

As has been mentioned previously, Apollo staking will utilise a similar staking mechanism to Curve and their veCRV. This means that users will be able to lock their Apollo tokens for veApollo, with both governance power and yield on these tokens depending on how many tokens are locked and how long they are locked for (up to two years).

Curve style governance staking provides a number of key benefits, predominantly aligning governance power and incentives with long term holders of Apollo. This staking model has proven to be extremely effective at both ensuring a long term view of governance decisions and locking up a large amount of the token supply, for example with CRV, over 50% of the supply is locked up for over 3.5 years and Frax has over 50% of their supply locked for over 1.5 years.

This style of governance staking is more complicated than what has so far been seen on Terra, but we also believe the benefits will resolve many of the current issues with governance on Terra and is therefore worth the extra time investment to get right. We are basing our veApollo design on Astroport’s vxAstro and have done this for two key reasons:

- As Astroport’s design for vxAstro is very close to what we have envisioned for veApollo, by utilising their code, it has allowed us to focus our dev resources on a number of other areas, which we will go into more detail below.

- As we will be creating a Convex like model on top of first Astroport, as well as other protocols that implement similar Curve style tokenomics. The more homogeneous these tokenomics designs are, the easier it will be for us to implement a Convex like model on top - something that we believe will benefit all projects involved. Once vxAstro and veApollo have been released, we believe we will see a number of other projects on Terra adopting similar token models.

We will also be adding some small, but specific modifications to vxAstro for our veApollo staking, including implementing the CW4 spec for our governance voting. At launch Apollo holders will be able to lock their Apollo tokens for veApollo, providing governance power (in terms of the Apollo platform, the Apollo Warchest and meta governance) and yield on these tokens. We will continue to enhance the functionality of veApollo on and ongoing basis, such as introducing the ability to boost Apollo vaults based on users holding of veApollo.

Where are we up to?

The launching of veApollo is one of our key priorities currently, and we believe that we will be able to begin auditing the code for this within the next few weeks and are aiming to release Apollo staking next month.

2. Single Asset Vaults

One of our next update will be the inclusion of single asset vaults on Apollo. To begin with this will include nLuna and nEth (from Nexus protocol) auto compounding vaults, which will be going live in the next few weeks, which coincides well with the increase on the LTV ratio on Anchor and the increase the the nLuna yield.

This will provide a number of benefits to our users, allowing them to easily earn a high yield on both their Luna and Eth holdings, without having any unstaking periods and provides a way to farm Apollo tokens with no risk of IL. This will also allow us to provide access to other opportunities, such as the Farmers’ Market for Luna and Eth holders as well as other future opportunities too.

Having developed the architecture to include single asset vaults, this will also provide Apollo the ability to list a number of other single asset vaults in the near future.This is just the first step for our single asset vaults and we aim to create a vault providing the highest yield available for Luna stakers by automatically switching between the highest yield available for Luna from a number of different strategies. This could include bLuna, nLuna, bLuna/Luna arbitrage as well as other strategies. While this is a little way off, we have begun laying the groundwork for it with these new vaults.

Where are we up to?

These vaults are completed and currently being tested ahead of release within the next few weeks.

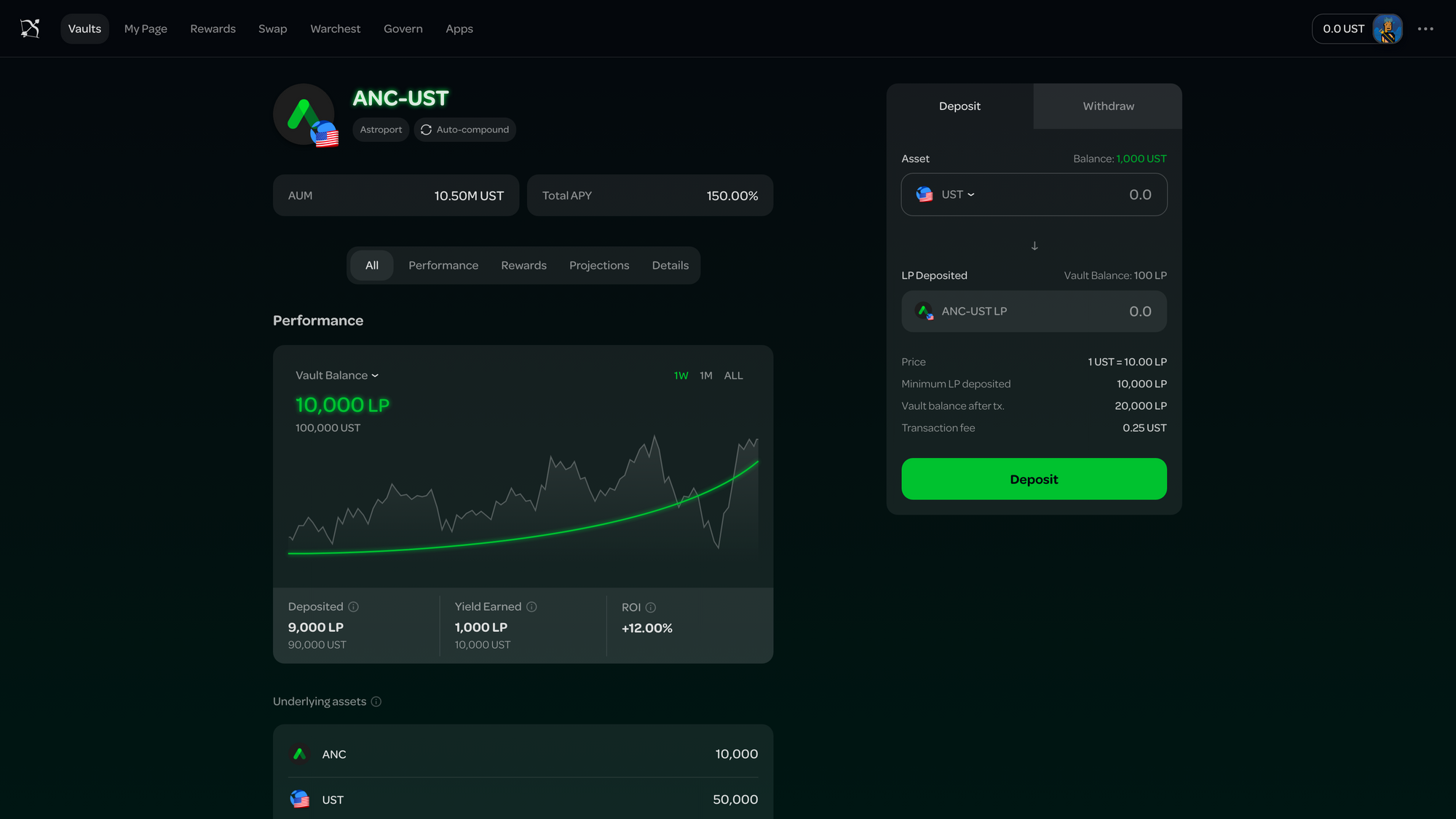

3. Astroport Vaults:

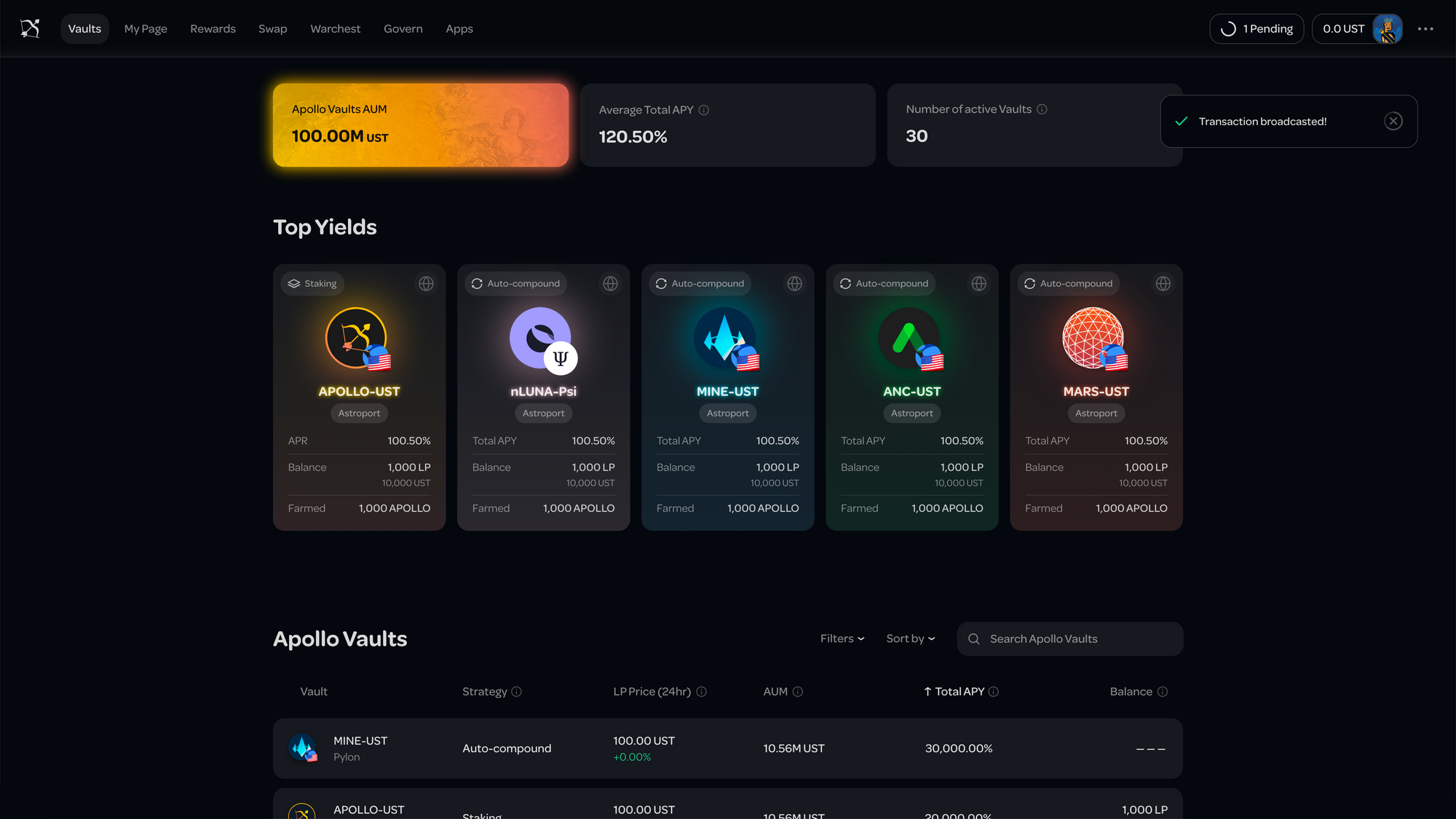

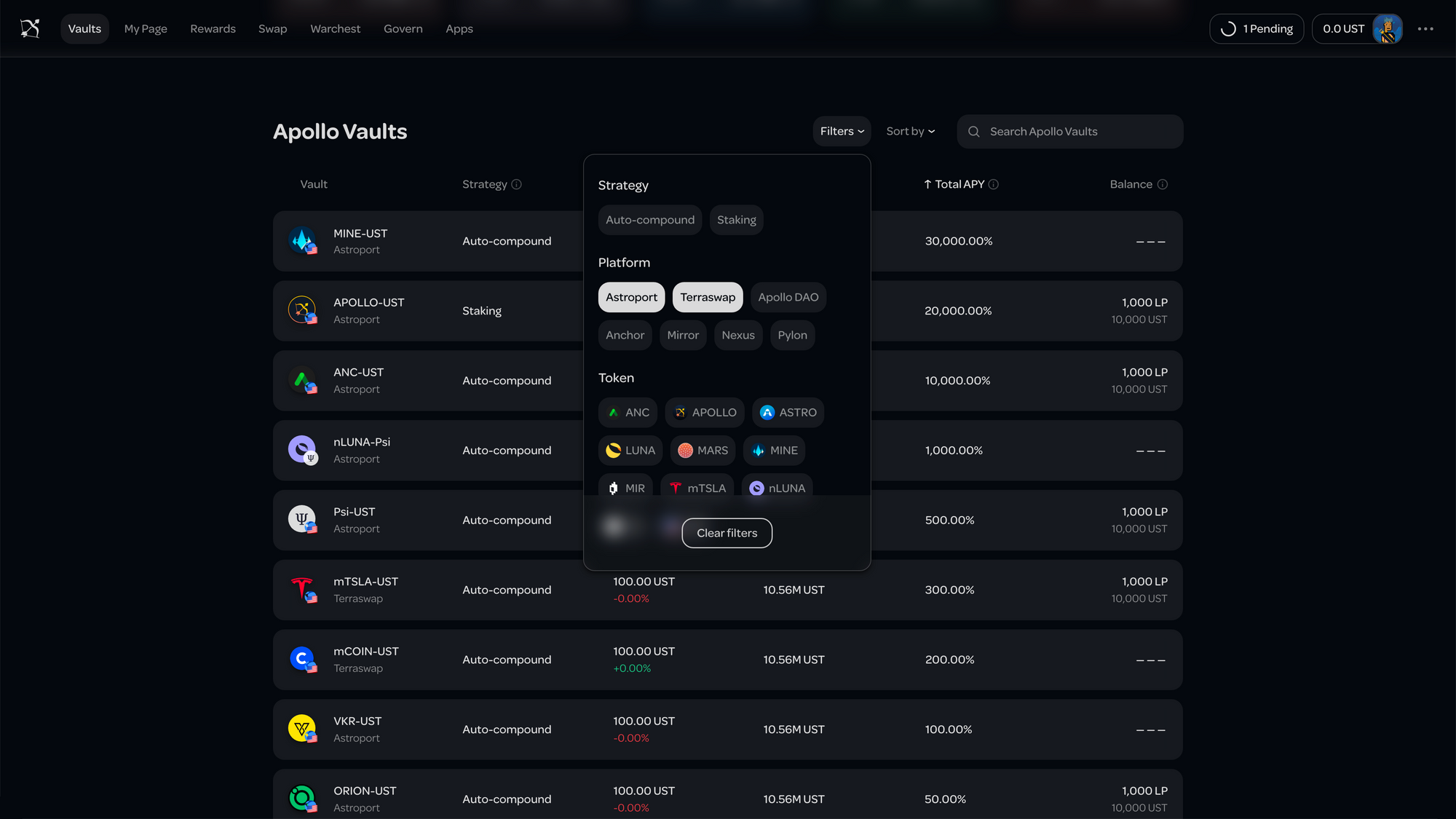

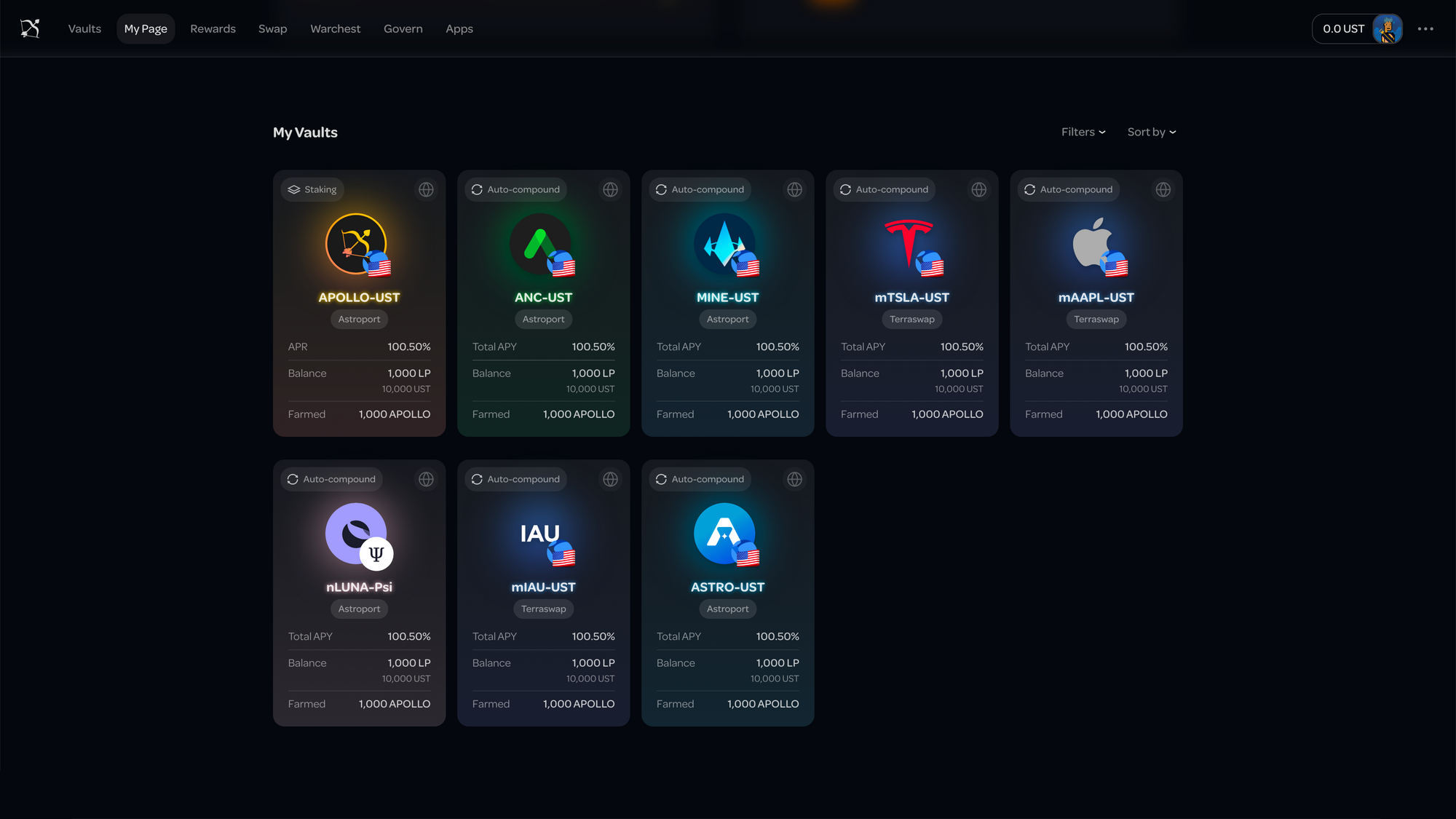

Due to some time constraints around the creation and launching of the nLuna and nEth vaults, adding additional Astroport vaults has taken slightly longer than we planned. As we have now finished the code for the single asset vaults; on the vault side, we will be shifting our focus back to Astroport vaults and will be adding all the UST based vaults over the next week or so and these will initially include: XDEFI, ORION, STT and VKR vaults.

Following these vaults, we will then be adding: wewstETH, wsstSOL and gOHM vaults, with additional vaults following soon after.

Where are we up to?

While we will be able to add the UST denominated vaults quickly, we will have to make a few minor changes to also be able to add the non-UST denominated vaults, such as bLuna/Luna, stLuna/Luna and LunaX/Luna vaults. These vaults will be added soon after the UST based vaults as part of wider improvements to the Apollo platform code base.

4. Apollo Vault tokens:

With the upcoming release of a number of money markets to Terra, such as Mars and Edge, we believe this is the perfect time to release Apollo vault tokens.

Vault tokens (represent your share of a vault and) are an auto compounding LP token, which greatly increase the composability of Apollo vaults with other Terra platforms, something we are very keen to develop. These will initially be released as part of our nLuna and nEth vaults, increasing the availability and choice of liquid, yield generating Luna and Eth, which can then be used for additional purposes, such as collateral. We will also be expanding the use of vault tokens to our LP vaults soon after. It is our belief that using these vault tokens as collateral will only be the first step and we are excited to see the additional resulting use cases.

The way in which they will work is by auto compounding the base yield and providing the Apollo tokens to the current holder of the vault token. This means not only can they be used a yield bearing collateral, but they will also provide Apollo to the holder of the vault token, such as lending platform, similar to the way in which bLuna works. We believe this could open up some interesting potential, such as reducing the cost of borrowing, passing these tokens back to depositors, or allowing lending platforms to accumulate Apollo. We will also be aiming to accumulate governance tokens for lending platform in order to improve the likelihood of Apollo vault tokens being listed.

Where are we up to?

The majority of the work has already been completed for our single asset vault tokens and they will be released very soon, with vault tokens for our LP vaults being released in the next month or so.

5. Farmers’ Market:

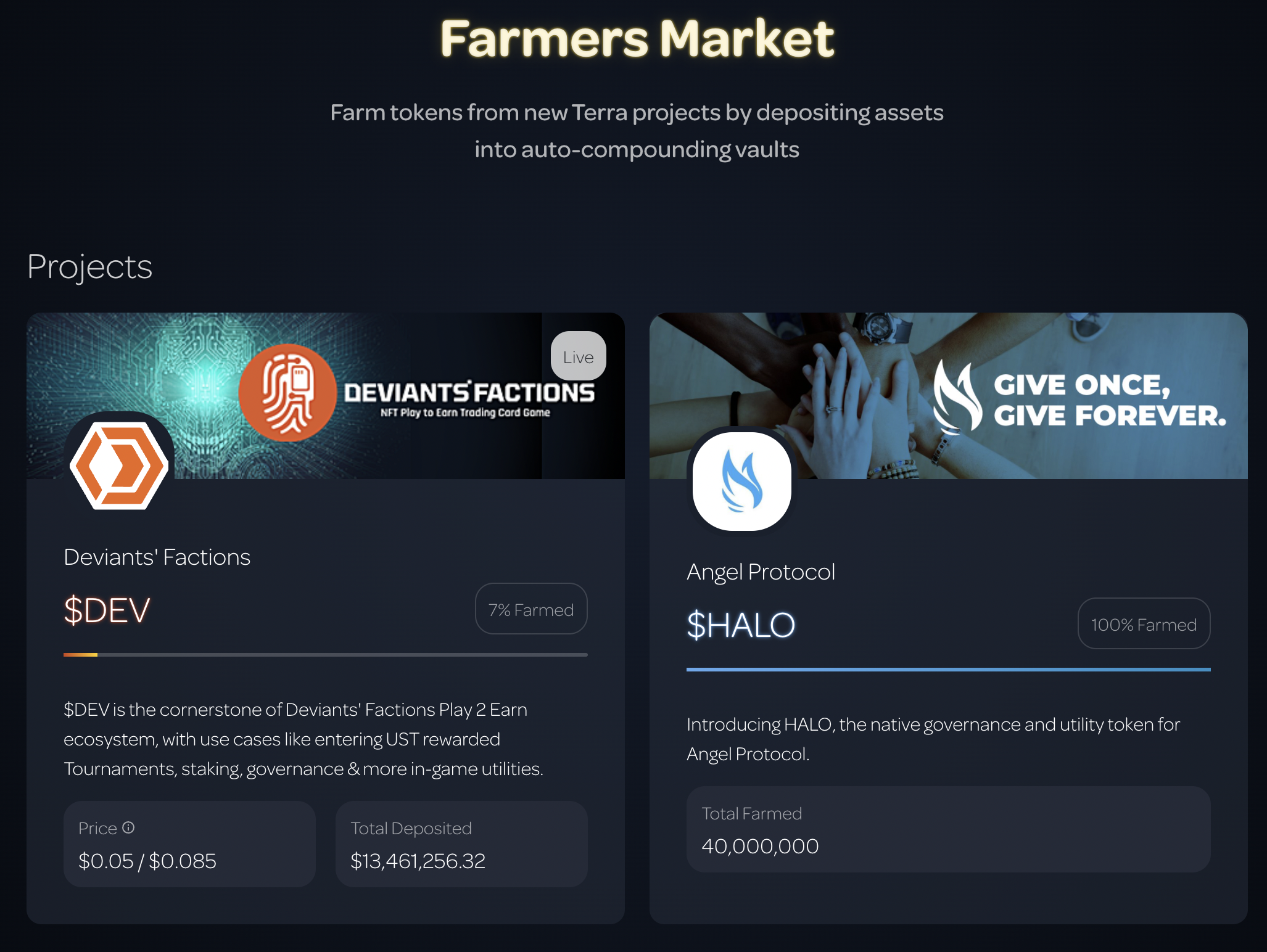

We initially launched the Apollo token through our Community Farming Event last year due to the fact we were keen to provide our community early access to the Apollo token, by allowing them to farm Apollo with a range of Terra LPs, without requiring KYC. After the success of Apollo CFE, we received a large amount of interest from other projects looking to launch their own token through a similar mechanism. However, this was not part of the original plan and the CFE platform was not designed to be scalable.

Thus was born the Apollo Farmers’ Market, initially starting with Angel Protocol (which was completely farmed in a matter of weeks) and recently launching Deviants’ Faction IGO, which attracted over $10m in liquidity in less than 24 hours.

Due to the interest we have received, we have put a lot of focus on enhancing the scalability and utility (such as creating the whitelist feature that allows users to simultaneously farm at different rates) of the Farmers' Market, so that we can continue to bring early access to new and exciting projects to our community. We have a number of other CFEs lined up and will continue to enhance this platform by offering a wider range of LP and single asset vaults that can be used to access these opportunities.

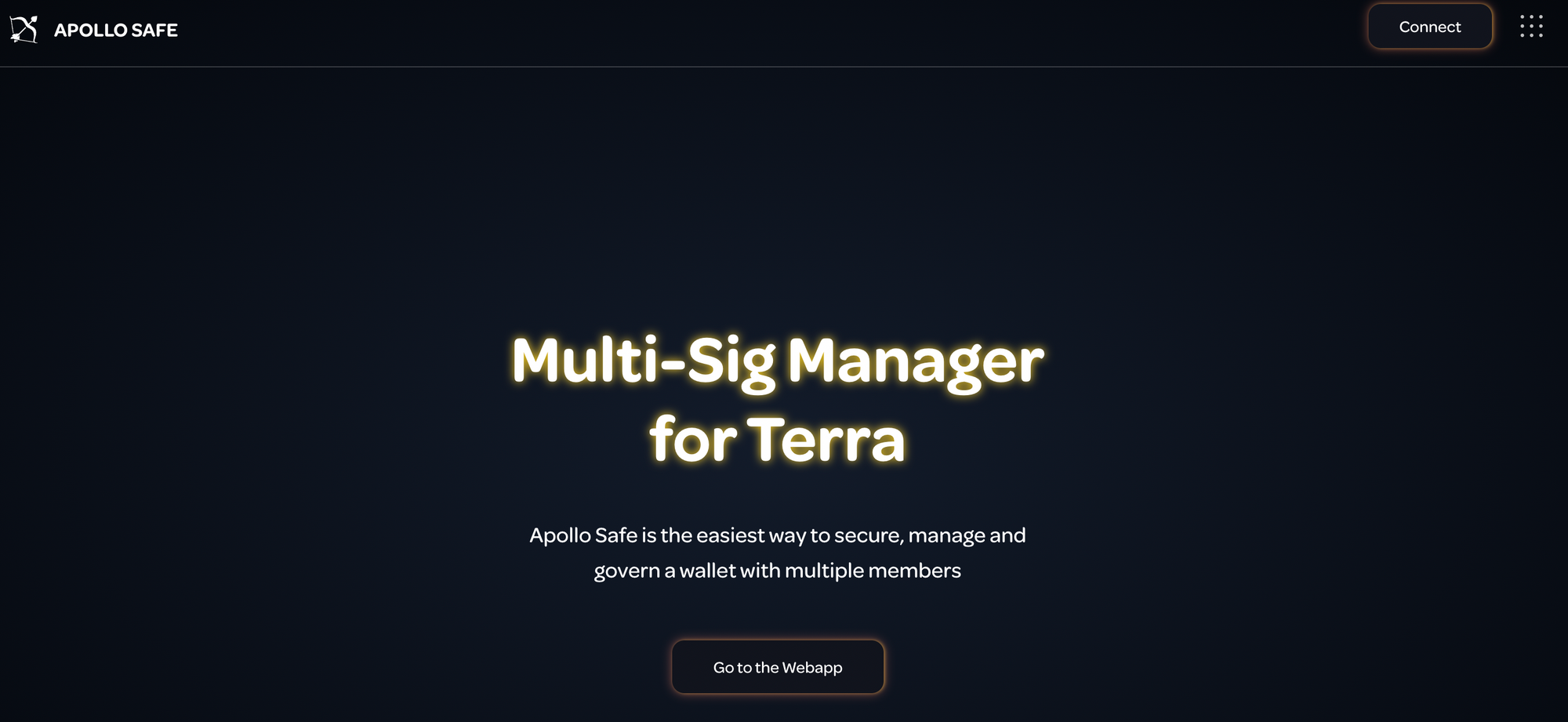

6. Apollo Safe

One of the key tools that we found was missing from Terra when we first launched Apollo DAO was an easy to use multi sig wallet that could be operated by the non-devs on the team. We initially built Apollo Safe as an internal tool to help manage the Apollo Warchest, but after extensive interest from a number of sources, we decided to fully build this out and release it.

While we invested a decent amount of time and resources into Apollo Safe, the decision was made to release this as a free to use tool for everyone, with plans to fully Open Source it. The key reason behind this is due to our strong belief that what is good for Terra is good for Apollo DAO, and we are keen to support and develop DAO and ecosystem tools.

This is just the V1 of our full vision for Apollo Safe, which we will continue to build and develop over time. However we have already received some amazing feedback and even played a small role in the historic Terra & Nationals deal:

Where are we up to?

The v1 Beta of Apollo Safe is available at safe.apollo.farm, but we will continue to improve functionality. We will be adding more custom messages, releasing Apollo Safe Flex, which will wallets to be added and removed from the multi-sig and will continue to work on Apollo Flows, starting with the "Apollo Salary Contract", which is currently being tested. Our full vision for Apollo Flows is a little further off however, but is something we will continue to work towards.

7. Convex Model on Terra

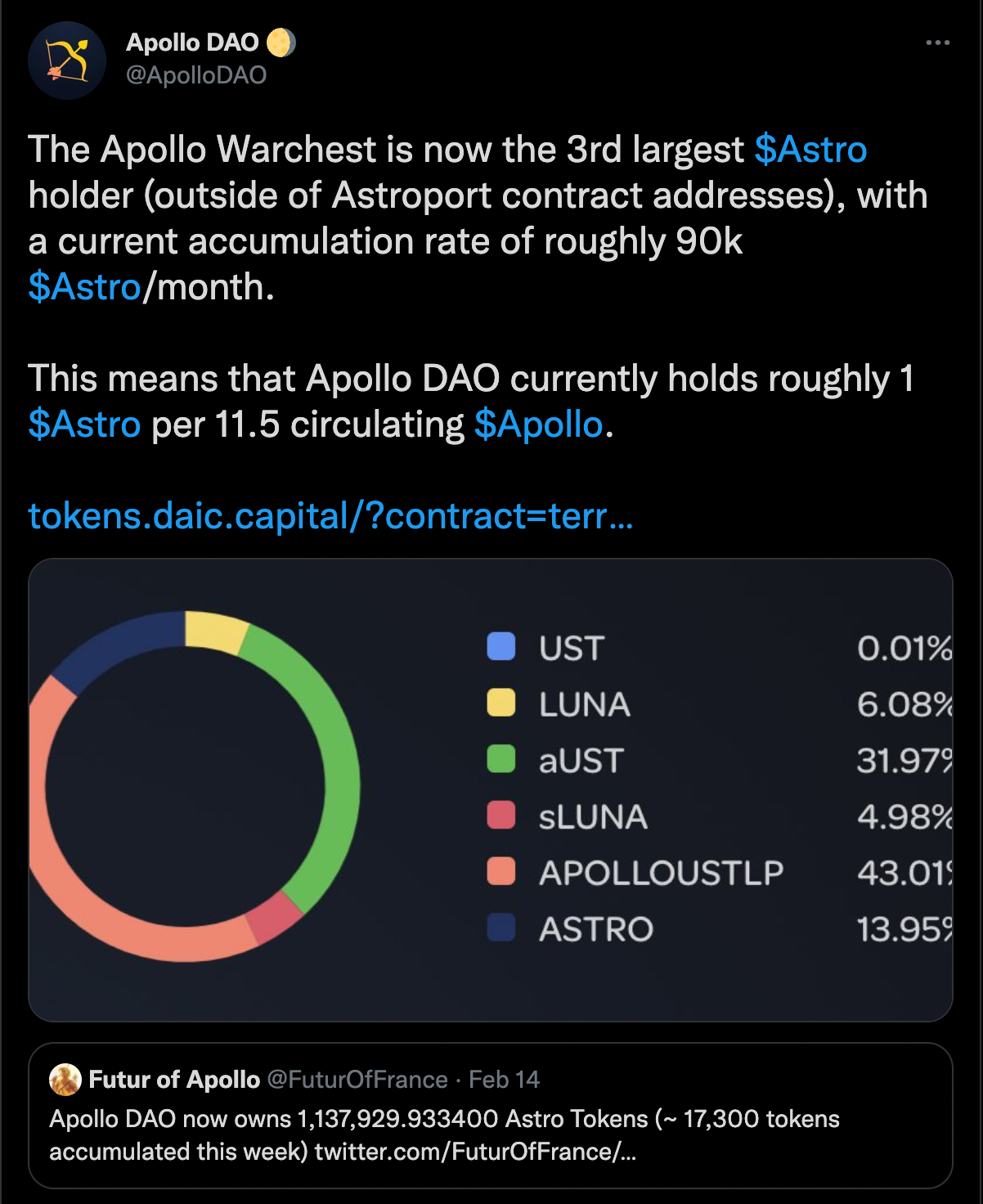

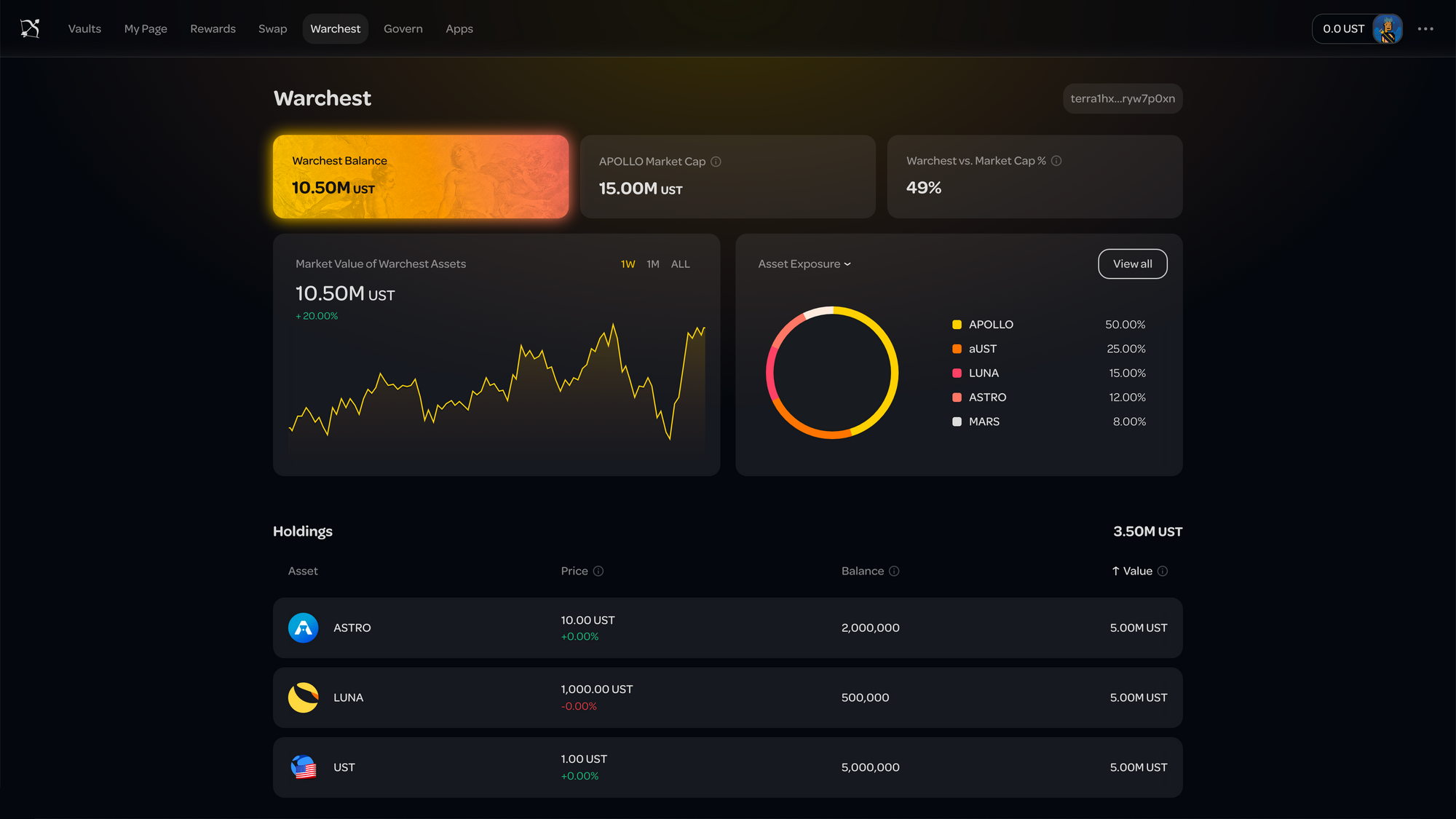

The Apollo Warchest has continued to accumulate $Astro and is currently the 3rd largest holder, however this is just the warm up prior to launching a Convex like model on Terra. We will keep the below explanation as simple as possible and will be releasing a lot more detail on this in the near future.

If you are looking for an overview of Convex, please check out this great and detailed overview of Convex from Yunt Capital:

And this Twitter thread from @shivsakhuja

The Convex model can work with any protocol that introduces Curve-like tokenomics (increased yield and governance power based on how long tokens are locked for), by allowing users to access high yields on their tokens, while remaining completely liquid. In simple terms it is able to do this by letting users swap their tokens for a “liquid staking derivative”, while max locking the underlying token and passing this yield on to the stakers of the “liquid staking derivative”.

With Astroport for example, users would have to lock their Astro tokens up for 2 years as vxAstro (and keep max locking them each day) to achieve the maximum yield. However with a Convex-like model, we will be able to allow users' Astro holdings to remain liquid, while also providing a higher yield on them than would otherwise be possible.

We have also been able to learn a number of lessons from the Curve Wars on Ethereum, such as while Convex was not the first to implement this model (the Yearn “backscratcher” being an earlier example), Convex’s ability to maintain a strong peg between cvxCRV and CRV has helped make it a clear winner so far.

While we are very impressed with the success of the Convex model, we will be making a number of small changes based on these lessons. Our predominant focus will be on maintaining the peg between Astro and our “liquid staking derivative” of Astro.

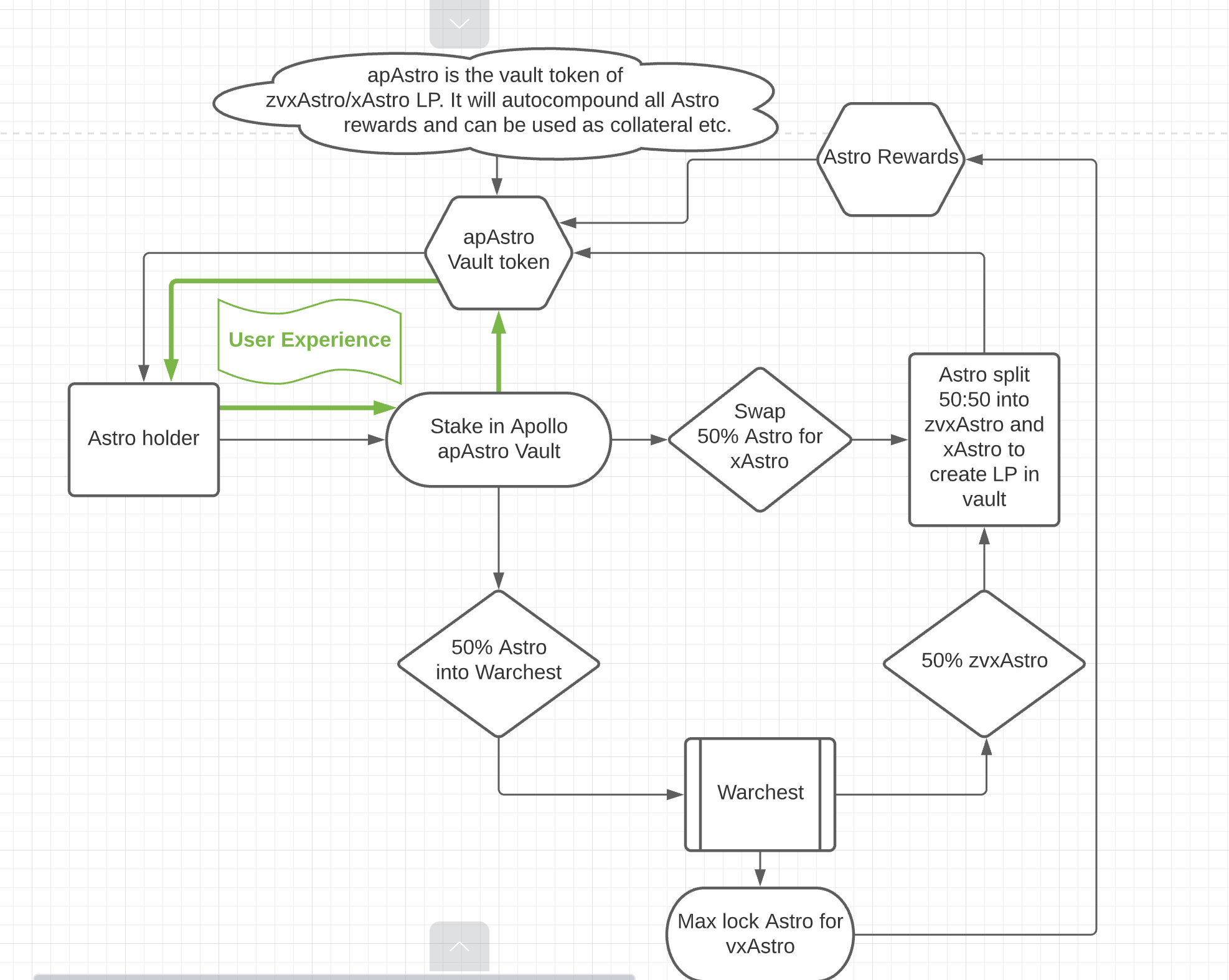

To do this, users will be able to deposit their Astro tokens with Apollo in return for apAstro vault tokens. apAstro will be an LP of xAstro and zvxAstro (our “liquid staking derivative” - to be renamed ahead of launch), similar to cvxCRV LP vault.

The way this will work is Apollo will convert 50% of the deposited Astro to xAstro and then max-lock the remaining 50% of Astro tokens as vxAstro, providing users with apAstro vault tokens.

All the yield from our max locked vxAstro yield will go the apAstro LP vault, as well as additional Apollo incentives. While this will mean a slightly lower yield that is we max locked 100% (as 50% of the LP will be in xAstro and not max locked), we believe this trade off is more than worth it due to the increased stability and liquidity, allowing users to enter and exit apAstro more efficiently and giving users more confidence that the peg will be maintained.

While this may sound a little complicated, our aim is to make the user experience as simple as possible.

apAstro will be auto compounding, liquid and have other advantages, such as the ability to be used as collateral.

In return Apollo will receive the governance and boosting power of the max locked vxAstro tokens, which will be used to boost our Apollo Astro vaults through “Boosties”. As a result of the success of cvxCRV, Convex is able to boost the CRV rewards for its vaults by at least 1.69x and some even near to the max 2.5x. This will allow Apollo to offer boosted Astro yields to all of our users, with the aim of providing the best yield possible on Terra.

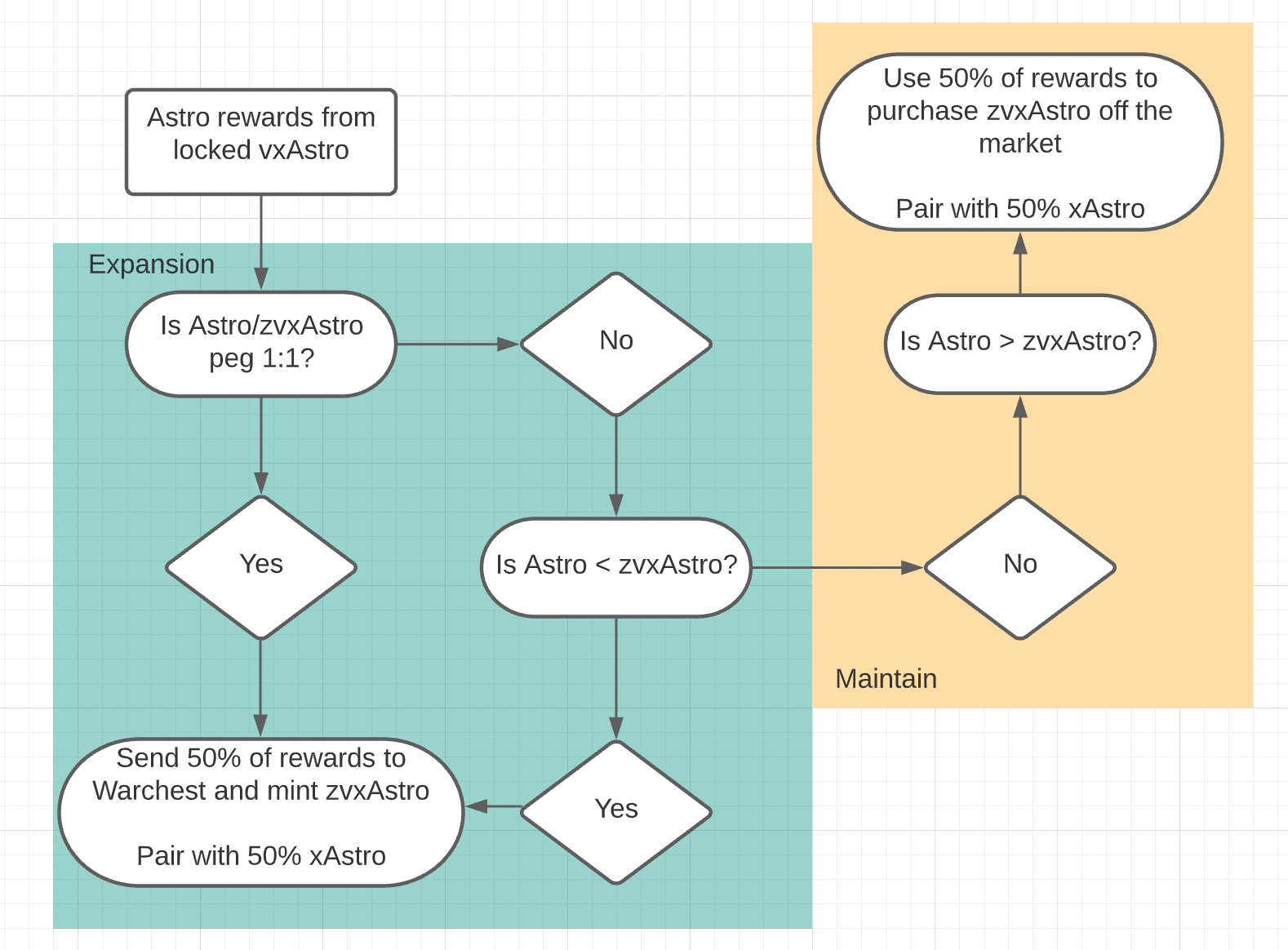

We will also be using the Astro rewards from our locked vxAstro to maintain the Astro/zvxAstro peg, so while the peg can be temporarily lost, we will then be able to use the rewards to bring it back to peg over time, also encouraging arbitrage to help maintain the peg.

Where are we up to?

These diagrams show a very simplistic overview of our design to demonstrate some of the differences we will be introducing. We have fully defined what we need to build to launch a Convex model on Terra and now that vxAstro is close to completion have begun the work to create and release this once vxAstro goes live.

8. Leveraged Yield Farming

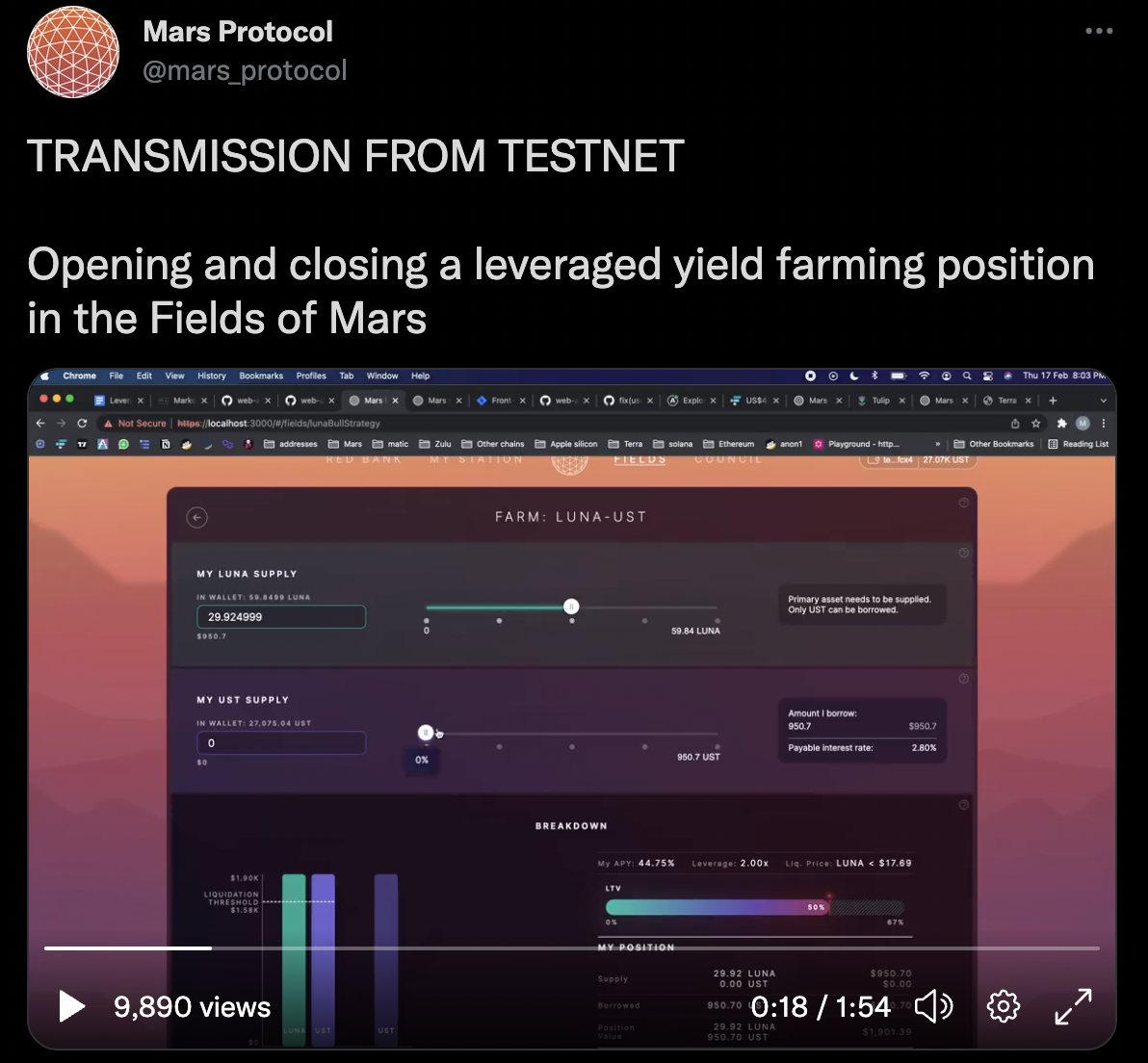

With the introduction of Mars, protocol to protocol lending will become possible on Terra, which opens up a number of exciting opportunities and will allow Apollo to offer leveraged yield farming. If you are looking for more detail on Mars and how this will work, we would recommend checking out the latest Twitter Space that they held this week:

In basic terms, Apollo will be able to take a credit line from Mars, allowing users to participate in leveraged yield farming, increasing the returns, but also the risks. The way this will work is that users will be able to enter Apollo vaults, and have the option of borrowing (initially) UST from Mars with no collateral, boosting their yields, but also meaning there will be a risk of liquidation based on price movements. Users can benefit from the increased yield, but will not be able to remove this capital from the platform (like when leverage trading on a CEX).

Where are we up to?

Mars has already done a lot of the groundwork for leverage yield farming and we are currently building out the contracts to enable leveraged yield farming on Apollo vaults.

9. Protocol Owned Liquidity and Apollo Bonds

The Apollo Warchest currently owns roughly 33% of the Apollo liquidity and is earning over $1.1m per year in rewards on these holdings (at current prices), with roughly $400k of this coming in the form of Astro tokens.

With the upcoming release of Olympus Pro on Terra, this provides Apollo DAO an opportunity to accumulate more Apollo LP, UST as well as other governance tokens we are aiming to accumulate, such as Astro. Bonds from OP have proven to be an extremely effective way to bootstrap treasuries, and will allow Apollo to generate and deploy Warchest capital much more rapidly and earn higher returns as a result. This is also part of our longterm strategy to ensure there will always be sufficient Apollo liquidity, even when Apollo rewards have ended.

Where are we up to?

We are currently awaiting the release of Olympus Pro and will be part of the first cohort on Terra. We are also looking at new ways to maximise the effectiveness of our bonds, such as allowing users to bond to veApollo directly. This will allow us to offer higher discounts on bonds to longer term users, but is something we will be working on after the initial release.

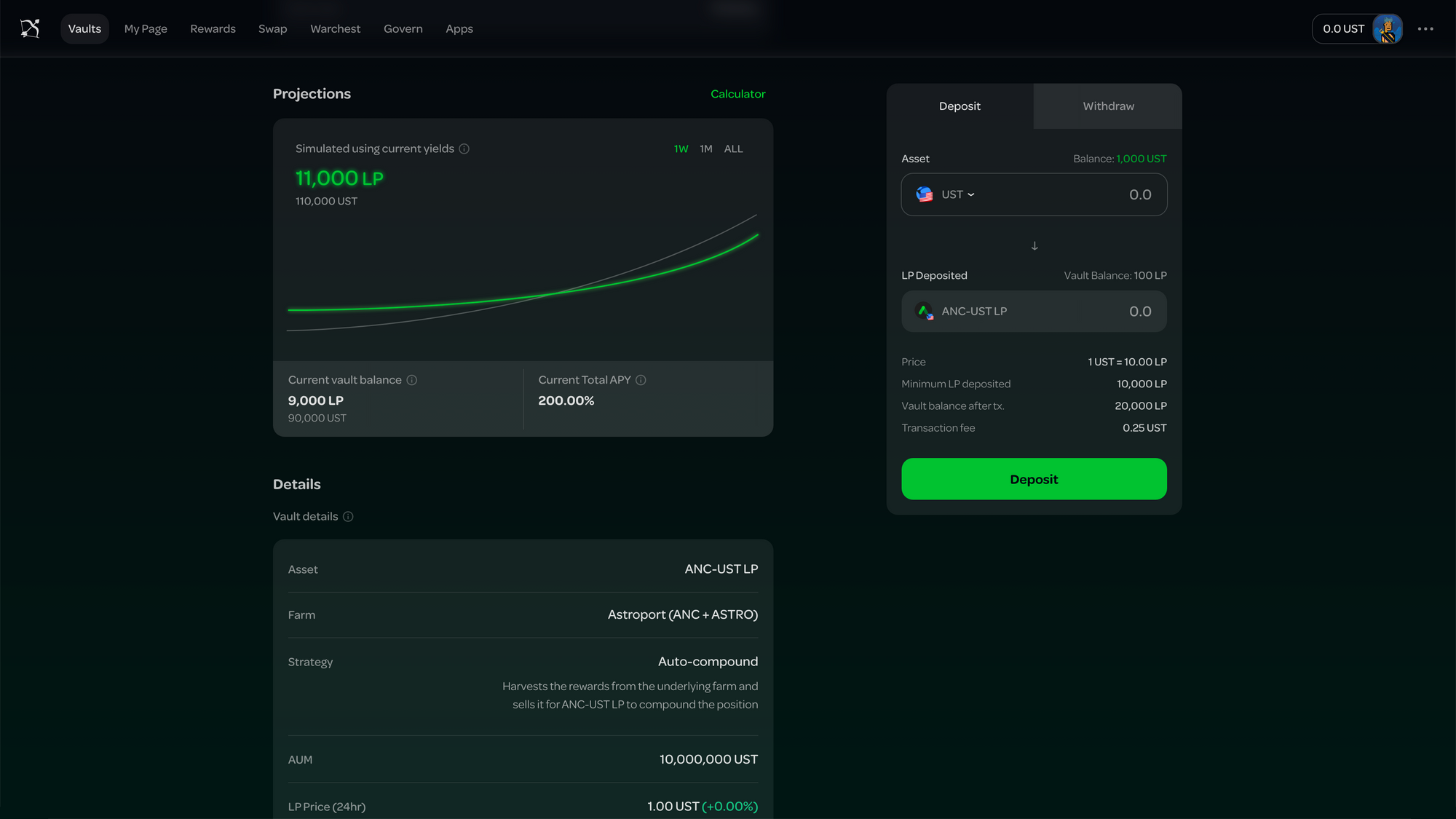

10. Apollo Improvements

While we are working on a number of new features, we will continue to improve the current Apollo platform. We are working on increasing the modularity of the Apollo code, improving our ability to re-use code for a number of different features. This will increase the speed at which we can continue to release new features in the future, such as being able to use code developed for our vaults for other features such as Apollo Flows. We have pioneered this new, more modular design with our single asset vaults and will continue to upgrade the current Apollo code to this new design.

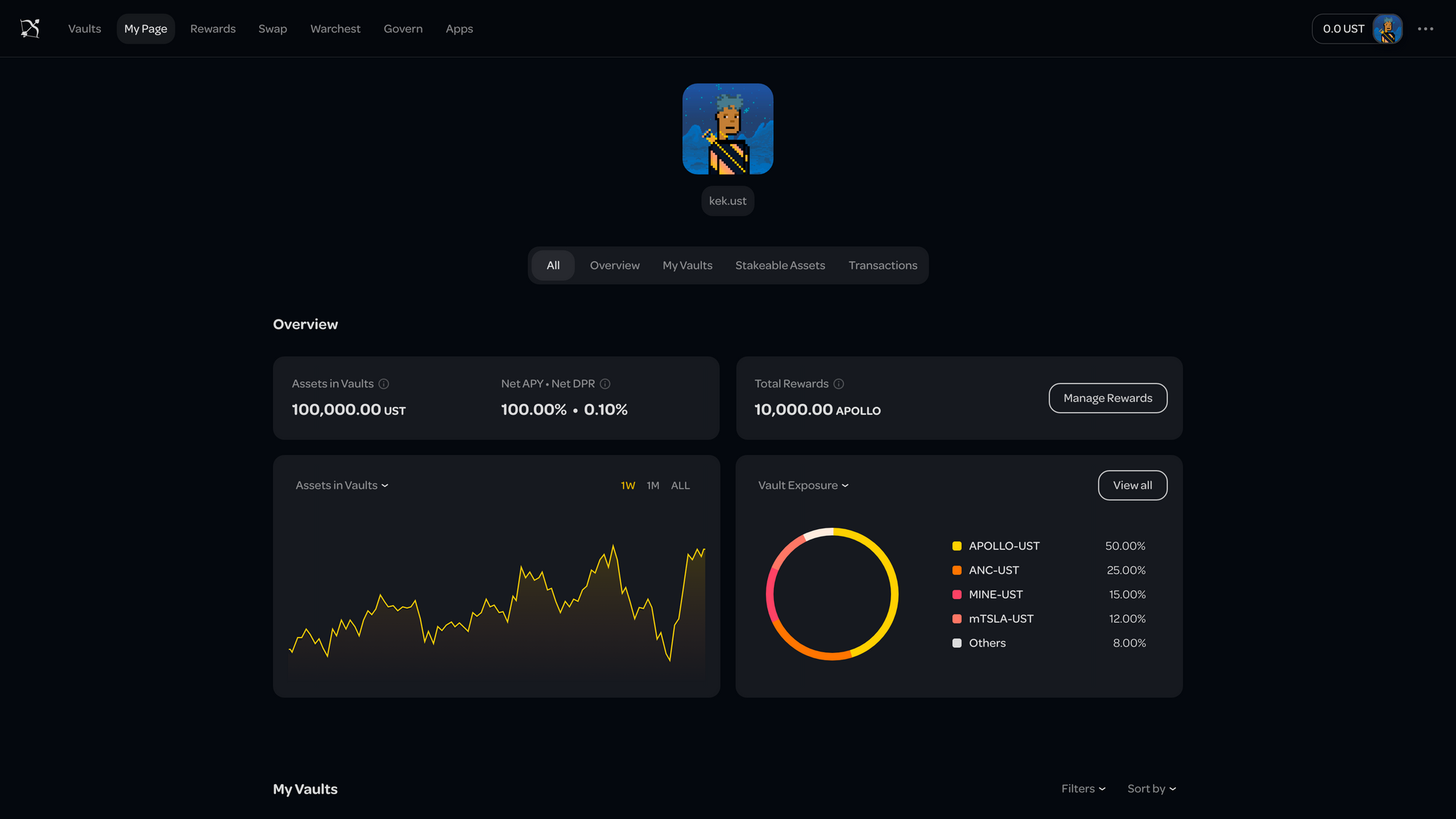

We have already redesigned the Apollo Vaults and will begin building out the new and improved front end soon.

11. Safety and Security

As we have mentioned previously, we have taken Halborn on a retainer basis, which will provide:

- A second set of eyes on our currently audited code

- Additional auditing, going beyond just smart contracts, such as pen tests

- Improved speed at which we can release new features as we won’t have to book and wait for specific audits, and can prioritise small sections of the code (such as veApollo), that we are keen to release quickly.

What's Next for Apollo DAO?

Overall rather than just working on one specific area, we have been working on a number of different parts of Apollo in parallel. While this has meant that some features have taken longer to release than they would have if they were the sole focus, it has allowed our devs to work in smaller sub teams and means we will be able to release most of the new features mentioned above in quick succession. This is all working towards the overall goal of Apollo DAO becoming a Decentralised Hedge Fund and being able to offer sustainable yield higher than otherwise available on Terra.

Moving forward we have a number of other plans ranging from continuing to add new vaults, to creating and implementing an NFT strategy, including our plans for NFT boosters, as well as continuing to be flexible in our development and monitor new protocols releasing on Terra for new and exciting opportunities to continue to bring benefits to our users. There is also the potential to launch the Apollo platform, (such as our vaults or Safe) on multiple CosmWasm/IBC chains, like Secret for example. Once governance goes live, this will also provide our community more control over where to direct our dev resources, based on where they believe the best opportunities for future growth are.

If you are looking for more insight and depth into these topics, you can check our our latest "Terra-Forming" Twitter Spaces and our recent appearance on Terra Bites:

Join our Discord

Join our Telegram

Follow us on Twitter