Apollo DAO’s Convex Model on Terra

With the recent release of xAstro and the imminent release of vxAstro there has been increasing discussion on the upcoming “Astro Wars” and the role the Apollo DAO will play. With a number of protocols also looking to start accumulating Astro, we thought this would be a great chance to go into a little more detail on what we have accomplished so far and our plans for the future.

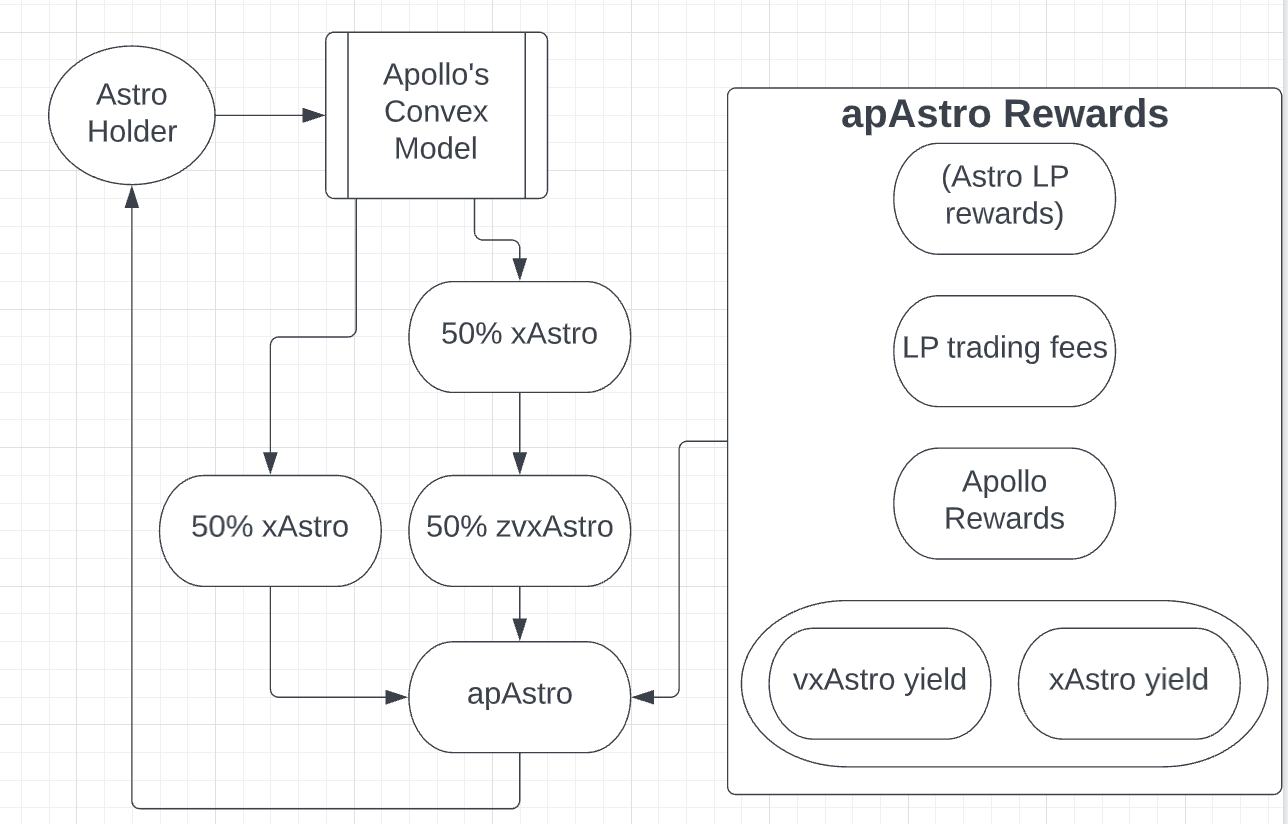

Apollo’s Convex model will allow Astro holders to deposit their Astro tokens into Apollo, providing them a high yield on their tokens (both in Astro and Apollo), without the need to lock up their Astro. Apollo DAO has innovated on the typical Convex model, allowing users to receive more yield inflows, deeper liquidity, and a stronger peg, than with competitor protocols.

By depositing your Astro with Apollo, you will be entering the apAstro (zvxAstro-xAstro LP) vault, which will receive yield from:

- vxAstro Rewards

- xAstro Rewards

- Apollo Rewards

- LP/trading fees

- (Potentially additional Astro LP rewards if voted on)

Apollo will focus on maintaining the peg between zvxAstro and xAstro in a number of ways, to ensure users can alway exit the vault with low slippage. In return Apollo will gain the governance and yield boosting power of these Astro tokens, which can be used to boost the yield on Apollo’s auto compounding vaults, as well as increasing the Apollo Warchest Astro holdings, which will be managed by veApollo stakers.

By directing all rewards to one vault instead of two, Apollo aims to not only provide the strongest peg with our Convex model, but also the highest long term yield.

For more information on Convex, the history of the Curve Wars and how this relates to Astroport, please read below, or skip to “How does the Apollo Convex Model Work?” to learn about Apollo’s Convex implementation.

Introduction to Convex, the history of the “Curve Wars” and how this relates to Astroport

You can find our introductory information on our Convex Model in our Roadmap post, under: (7. Convex Model on Terra).

What is an “Astro War” and who are the players?

“Astro War” is in reference to the “Curve Wars”, where DAOs and large users compete to accumulate as much CRV as possible in order to provide the maximum boost to their LP pools. Both veCRV and vxAstro allow you to get higher yield and governance power the longer you lock up tokens for. This governance power can also be used to boost the yield on the LP vaults on the respective platform.

Due to the increasing amount of crypto trading taking place on-chain, liquidity has become extremely important for a large number of DeFi projects, including governance tokens, synthetic stablecoins and Luna staking derivatives. Attracting liquidity to your token LP can be expensive, however we have seen a large amount of innovation in this area; ranging from Olympus Bonds, to Tokemak and to projects accumulating CRV and CVX in order to boost the yield of their LPs in a more sustainable way. The way this works is that rather than constantly paying for LP liquidity through emissions, you can accumulate CRV and CVX and use the governance power to direct rewards to your pool. You can also bribe the holders of CRV and CVX to use their governance power for your pool too.

On Ethereum the Curve Wars have been dominated by Convex, however due to the fact that projects have been able to learn from the success of Convex, and the fact there is no project whitelist on Astroport (as there is on Curve), it is likely that we will see a far more open playing field for a variety of projects and individuals to succeed as part of the Astro Wars.

So far it looks like Apollo DAO, Retrograde, Reactor and Spectrum are looking to launch Convex models on Terra, with projects like Redacted Cartel looking to bring “bribing” for Astro boosting (as well as other meta governance tokens) to Terra too. We believe it will be far healthier for the growth of Astroport and the Terra ecosystem, with a variety of different projects accumulating Astro, rather than being controlled by one market participant and will also be better for Astro farmers and holders and users as protocols compete for their tokens.

Why is Astroport Governance Valuable?

There are two main reasons that Astroport Governance will be valuable:

1/ Boosties: “vxASTRO holders who are also Astroport pool LPs mining ASTRO through the ASTRO Generators will receive a boost (from 1x to 2.5x) to their share of ASTRO emissions.”

This means the more vxAstro a user has, compared to the value of their LP staked in Astroport, the higher Astro rewards this user will receive. This also means that if a DAO, such as Apollo acquires a large amount of vxAstro, the Astro yield for all of Apollo’s LP Vaults can be boosted. This is based on the following formula:

2/ Voting on Astroport pool reward rates: As well as Boosties, vxAstro will also provide governance power to vote on Astro reward rates for pools. This will be both for existing pool rewards, as well as which new pools to add. Having some control over this process will be very beneficial for Apollo DAO and our Vaults. veApollo stakers will be able to control this governance power, through Apollo’s meta governance system, more info on this in our staking article here.

Through these two methods, if Apollo can attract a significant amount of Astro compared to the TVL in our LP vaults, we will be able to offer more attractive vaults, improving the user experience.

What is a Convex Model?

The most simple explanation is that it is a way for Astro holders to get a higher yield on their Astro tokens, without having to lock them up as vxAstro. In return they will give up the boosting and governance power of these Astro tokens to the DAOs/protocols they deposit their Astro with.

This provides a way for users who are looking for a high yield on their Astro tokens, but want to also remain liquid. For Apollo DAO, this will provide another way to bootstrap our treasury with more Astro, which will then be used to boost the Astro yield on all our LP vaults, making them more attractive and with the aim of increasing TVL.

Another big advantage is that in order to maintain the maximum yield and boost from vxAstro, users would have to continually max lock it and if they wanted it back, it would take 2 years of gradually lowering yields. With a Convex model, users can be constantly earning a high yield and also remain liquid incase they want to exit.

Convex models have proven to be an extremely cost effective way to attract a large amount of capital permanently into a treasury/Warchest. The more Astro that the Apollo Astro vault can attract, the more Astro veApollo stakers will control, which will further increase the desirability of the Apollo rewards from the apAstro (and other vaults), making these vaults more attractive.

How does the Apollo Convex model Work?

Users will be able to deposit their Astro tokens with Apollo and in return the user will get apAstro (zvxAstro-xAstro LP), an auto compounding and redeemable vault token that can be swapped for liquid Astro/xAstro. We will also be working on additional functionality for apAstro, such as having it listed as collateral on lending platforms.

To create apAsto and ensure there is always deep liquidity to trade, Apollo will max-lock 50% of the deposited Astro tokens as vxAstro and mint zvxAstro, which is paired with 50% xAstro. All of the Astro rewards for the max locked vxAstro, as well as additional Apollo rewards are provided to apAstro holders.

From the user's perspective, they will be able to enter and exit the apAstro vault anytime, earning Astro and Apollo rewards while in the vault. By utilising the apAstro LP vault and directing all the rewards here (rather than having a single staking vault for zxvAstro), we can ensure that the bigger the Convex model becomes the more liquidity there will be.

While this may seem slightly complicated, Apollo’s mission will be to provide a straightforward user experience, while providing all the benefits of a Convex Model.

How can the Astro accumulated by the Convex Model be utilised?

For Apollo, this Max Locked vxAstro will provide a number of benefits:

- Will boost the Astro yield on all our LP vaults.

- Will provide governance power over which new and current vaults should get rewards and how much.

- The Astro voting power will be passed to veApollo stakers.

- Users without veApollo can bribe veApollo stakers to vote for certain pools.

All of the governance/voting power of the Astro accumulated by the Convex Model will be managed by veApollo stakers.

For example if there is 25m Astro Max Locked as vxAstro and there are 50m veApollo, then for each 100 veApollo a staker has, will control 50 Max Locked vxAstro. The veApollo stakers can either decide to use this voting power directly for their favourite LP vault, or they can choose the “delegate” this voting power, which can then be bribed for by users or DAOs who want to boost their own LP rewards.

What are the main risks of a Convex Model?

The main risk of any Convex Model is the loss of peg between the liquid staking derivative (in Apollo’s case zvxAstro) and xAstro, as this could mean that users who are exiting would receive less Astro back than their current balance.

Maintaining the peg between these two assets will be one of the primary focuses of Apollo’s Convex model and we have been able to learn a number of lessons from Convex and their competitors, as well as add a number of improvements.

Convex is currently paying over $60m/year just in CVX tokens to its cvxCRV/CRV LPs and is offering nearly 10% more yield to its LP pool vs its single staking of cvxCRV. We believe Convex’s focus on maintaining the peg has been one of the main reasons for its dominance.

What will make Apollo’s Convex Model different?

It currently seems like there will be a range of Convex solutions coming to Terra, each with their own strengths and weaknesses, that will likely appeal to different users.

1/ The first major difference of Apollo’s Convex Model, will be our focus on the peg, which will be done in a number of different ways.

a. Rather than having two separate vaults that rewards have to be split between, Apollo will be focusing all rewards on the apAstro (zvxAstro/xAstro) stableswap LP vault. Convex currently offers 52% APR (predominately in CVX) on their LP vault and 45% on their single sided vault. By combining both of these vaults into one, we believe it would increase both the yield and the liquidity. While only half the xAstro would be max locked, it would ensure that there will always be enough liquidity to exit for users, as the majority of the circulating zxvAstro will be in the apAstro vault (as this will provide the highest rewards).

veApollo stakers can also use some Astro governance power to begin directing additional Astro LP rewards to the (zvxAstro-xAstro) LP pool, increasing the yield , which when combined with LP swap fees from users entering and exiting the vault, it could potentially offer a higher yield than if we had two vaults.

All Convex models will need to incentivise an LP pool, either with Astro or native token rewards, to ensure there is enough liquidity to enter an exit. The higher the yield of the single sided pool, the more attractive the yield for LP pool will need to be in order to maintain sufficient liquidity. Based on their current liquidity, if Convex combined both their single staking cvxCRV and their cvxCRV/CRV LP vault, they would increase the yield on this one vault by around 8%.

Users will have the same Astro price exposure, with more confidence that the peg will be kept and will get rewards from:

- vxAstro Rewards

- xAstro Rewards

- Apollo Rewards

- LP/trading fees

- (Potentially additional Astro LP rewards if voted on)

The apAstro vault token will be auto compounding and compostable, so theoretically could be used as collateral to borrow Astro, while still earning all the fees and rewards, massively increasing the capital efficiency potential.

b. Apollo will also be aiming to get the zvxAstro-xAstro stableswap pool additional Astro LP rewards, which would further boost the yield of apAstro. With a large amount of Astro voting power, this would significantly increase the total yield of apAstro and could potentially balance out the reduction in yield due to utilising an LP vault.

c. The vxAstro that Apollo Max Locks will generate a large amount of rewards from the trading fees on the Astroport platform. These rewards will be used to reward apAstro vault depositors with yield, by compounding them into their apAstro (zvxAstro-xAstro LP) (50% of rewards are converted to xAstro and the other 50% converted to zvxAstro and compounded).

However they will also be used to balance the peg while doing this. If zvxAstro is on or above peg, the Astro will be locked in the Warchest, new zvxAstro will be minted and the supply of zvxAstro will be increased. If zvxAstro is ever below peg, zvxAstro will be purchased off the market to pair with the xAstro. This means that if users are exiting from the apAstro vault, rather than continuing to increase the supply of zvxAstro with rewards, the buy pressure will instead be used to buy up cheap zvxAstro and add stability.

While veCRV has a pretty low yield of around 5% APR (with most of the value coming from voting and bribes), vxAstro is very likely to offer a much higher yield on Max Locked vxAstro (based on current yields), greatly increasing the effectiveness of this method’s ability to keep the peg.

d. We will go into the options for the current Warchest holdings of Astro, but the rewards from these holdings could also be used to support the peg, in a similar way by being used to buy up zvxAstro if it is ever below peg.

e. We are continuing to look at new ways to help strengthen the peg and by building in the automatic buyback of zvxAstro vs minting when it is below peg we can continue to build on top of this. For example if Apollo is earning bribes from its Astro voting power, these rewards could be again used to buyback, or mint new zvxAstro based on the peg.

2/ The second major difference will be an inbuilt bribing pool.

The aim of this is to improve the user experience, as some veApollo stakers will be keen to use the Astro voting power to boost their favourite LP vault, others may prefer to take a less active role and just receive extra rewards on their veApollo.

The way this will work is that every 2 weeks veApollo stakers will be able to vote on which vault they would like to direct their Astro voting power to. However not every veApollo staker will also have an LP vault they want to boost and may not want to be actively choosing their gauges every two weeks. Therefore if veApollo stakers don’t vote with their share of the Astro voting power, it will automatically be delegated to the bribing platform, which will then earn them additional rewards.

Interestingly, due to Apollo’s large Apollo LP position, if there is ever a low demand for bribes, the Apollo Warchest could step in at a certain determined price level and bribe veApollo stakers to increase the yield on the Apollo LP vault. Basically it would come down to: is boosted Astro rewards > cost of bribes. This would set a floor value for the bribes and the additional rewards veApollo stakers could earn. This also makes the experience of being a veApollo staker more active or passive depending on a user's needs, while benefiting each in their own way.

There are also a number of other small differences and slight improvements we have made and will continue to make to our Convex Model and will be releasing more information over time.

3/ The Apollo token: Apollo DAO has already built several revenue streams and will have launched veApollo staking ahead of the launch of our Convex model, providing constant value accrual to the Apollo token. By staking their Astro tokens through Apollo, users will be able to farm additional Apollo rewards with just Astro exposure and no IL.

4/ Integrating Astro Boosting into our other Vault features: By accumulating Astro through our Convex Model, boosting the yields on our LP Vaults, we will also be able to integrate these boosts into our current features, such as auto compounding vaults and future features, such as leverage yield farming and other new additions coming to the Apollo platform soon.

While there is clearly a lot of competition for Astro tokens, with multiple Convex models launching, overall this is very beneficial for Apollo DAO. This competition will accumulate a much higher percentage of the constant inflation of Astro tokens, due to their strong utility. This will boost the value of the Warchest, as well as all the yield from Astroport Vaults, meaning Terra becomes an increasingly attractive place to farm. We also believe with the benefits of the Apollo Convex model listed above, combined with our current Astro holdings and revenue sources, we will be able to attract a large amount of Astro tokens over time.

What will Apollo DAO do with the Astro accumulated so far?

Currently the Apollo Warchest has so far accumulated 1.3m Astro ($5m) and is currently staking for xAstro. Apollo will be able to utlise these Astro to not only help bootstrap our Convex model, providing a large amount of initial liquidity and boosting the yields on Apollo’s LP Vaults, but our Astro tokens can also be used to provide additional support to the zvxAstro-xAstro peg.

Next Steps

The next step for Apollo will be our xAstro Lockdrop, which we will be announcing the full details for this week.

Apollo’s xAstro Lockdrop will follow a similar format to previous Lockdrops from Delphi and Kinetic. Users will have 5 days to deposit and lock up xAstro for 3, 6, 9 or 12 months in return for a share of a fixed amount of Apollo tokens. At the end of their lock period, xAstro depositors would get their Astro back, plus all the Astro yield from during the lock period, as well as the additional Apollo rewards.

The deposited xAstro will be held until the launch of vxAstro and Apollo’s Convex model. At this point 50% of the xAstro will be used to mint zvxAstro (sent to the Convex contract) and paired with the xAstro to create the initial liquidity. Depositors would then get locked apAstro, which would be compounding all the rewards until it unlocks.

While Apollo’s Lockdrop will help to bootstrap the initial liquidity, our main focus will be on the long term sustainability of our Convex model and we will also be providing ongoing Apollo rewards to boost the yield for xAstro deposits.

Join our Discord

Join our Telegram

Follow us on Twitter