Deep Dive II

Apollo DAO: The Decentralized Hedge Fund.

Following our high level overview of Apollo DAO earlier this week, we wanted to provide a deeper look into our vision for Apollo DAO: The Decentralized Hedge Fund.

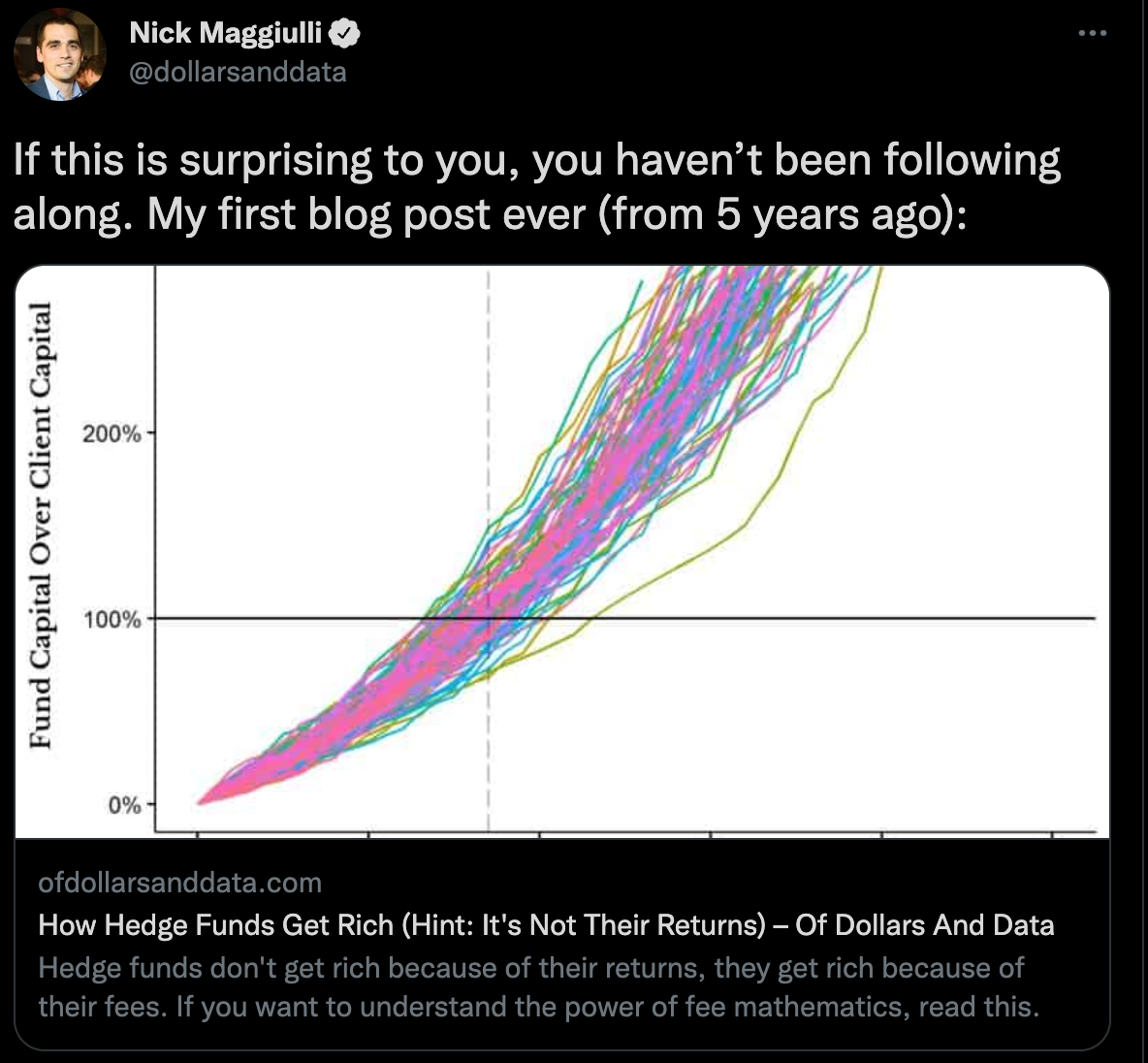

Traditional Hedge Funds currently manage over 3 Trillion of assets, 30% more than the entire Crypto marketcap. Despite this, these funds are often lambasted for low returns and high fees, with a model designed to enrich fund managers rather than the LPs.

Last year only 3 Hedge Funds (from Bloomberg’s list) managed to outperform the S&P 500’s 29% annual return.

In contrast, the Apollo Warchest has grown by over 275% in the 75 days since the end of our Community Farming Event. While it is still early on in Apollo DAO’s mission towards the lofty goal of disrupting the "Trad Hedge Fund model", we wanted to share our early progress over the last two and a half months since the end of the Apollo CFE.

In this post, we will be exploring:

- What is a decentralized hedge fund and what are the advantages?

- How will Apollo bootstrap this hedge fund?

- The Apollo Warchest and performance so far?

- Warchest and the Apollo token.

The First Decentralized Hedge Fund built on Terra

The aim of Apollo DAO is to create the first decentralised hedge fund built on Terra. The Apollo token is not only used to bootstrap the initial funds for the Warchest - by distributing tokens to users of our DeFi protocols in return for fees - it also provides our users an “entry ticket” to become members of Apollo DAO and managers of the Hedge Fund. This will allow them to govern and benefit from the success of the Apollo Warchest.

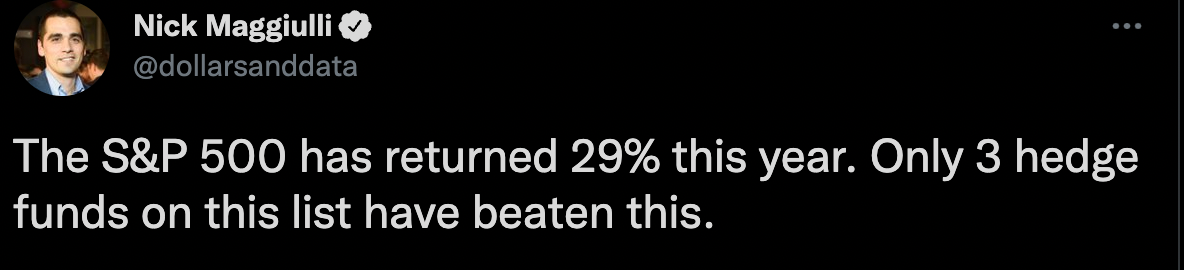

Apollo Currently Has three main DeFi Products:

Our ethos has always been to build what we need to manage Apollo DAO and then release those tools to the community, using them to bootstrap the Apollo Warchest through fees, in return for Apollo tokens. We will continue to develop and expand the functionality of our current protocols, as well as releasing new DeFi products.

- Apollo Vaults: Our flagship product and our initial bootstrapping mechanism for the Apollo Warchest: app.apollo.farm

- Apollo Farmer's Market: Initially created for the Apollo Community Farming Event and later adapted to the Farmer's market to host Angel Protocol and the Halo token. Due to the success of these events, attracting between $60m to $200m, we will be bringing more CFEs to Terra this year through the Farmer's Market. https://farmers-market.apollo.farm/

- Apollo Safe: A multi sig front end to the CW3 contract built by the CosmWasm team. Our front end is designed to make the additional benefits and features of multi-sig wallets available to all. Apollo Safe is currently in closed beta testing, with beta access being opened to all next week. Apollo Safe will be a free and open source product, but will have additional features and functionality, that may require staked Apollo in the future. [Redacted]

Our ethos has always been to build what we need to manage Apollo DAO and then release those tools to the community.

Advantages of a Hedge Fund on Terra?

Terra also enables some great additional functionality for a Decentralised Hedge Fund, that is not possible on other chains, such as easy access to a 19%+ yield on stablecoins, and a variety of great farming opportunities.

The Apollo team has been able to leverage our connections and experience from launching a DAO on Terra, to support and guide new projects and teams. Apollo aims to supporting builders, as well as benefiting both Apollo DAO and the wider Terra ecosystem, by supporting the launch of new protocols.

Apollo DAO will not just benefit from the plethora of high yield opportunities currently available or coming to Terra soon. We have also learned a lot from "DeFi 2.0" on Ethereum such as the importance of Protocol Owned Liquidity and CRV in the Curve Wars.

While so far Apollo has focused on Terra; through IBC and Wormhole, Apollo DAO will be able to benefit from cross-chain opportunities and with increasing decentralization, we will be able to research and invest in far more opportunities across the ecosystem.

While we are still taking the first steps in our mission, we wanted to provide a deeper dive into Apollo DAO’s performance so far, as well as the future advantages that we see with a decentralized model.

Apollo Warchest Performance so far

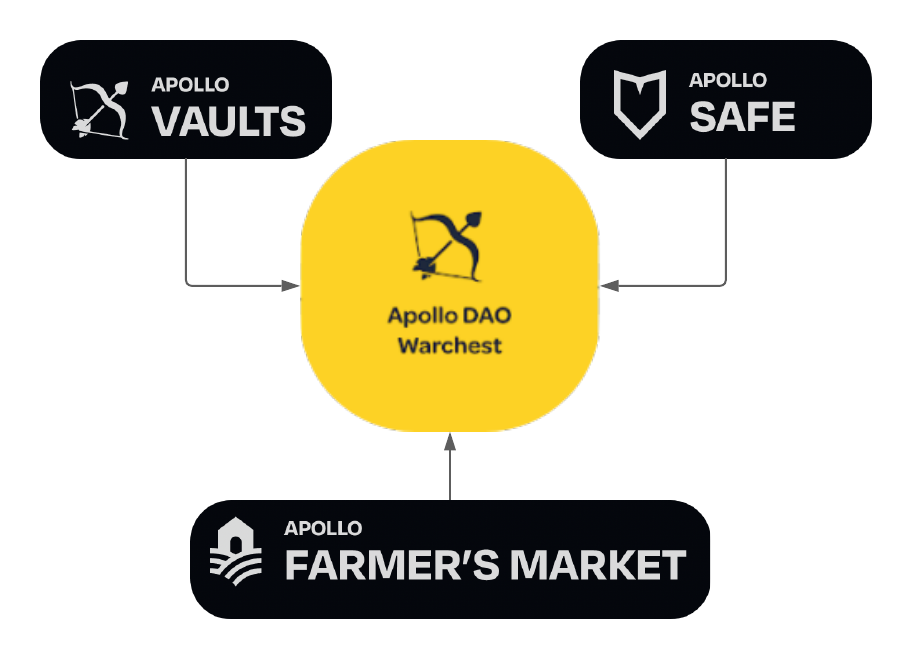

*These values constantly fluctuate, you can track the current performance of the Apollo Warchest at: [Warchest Dashboard - Coming soon]

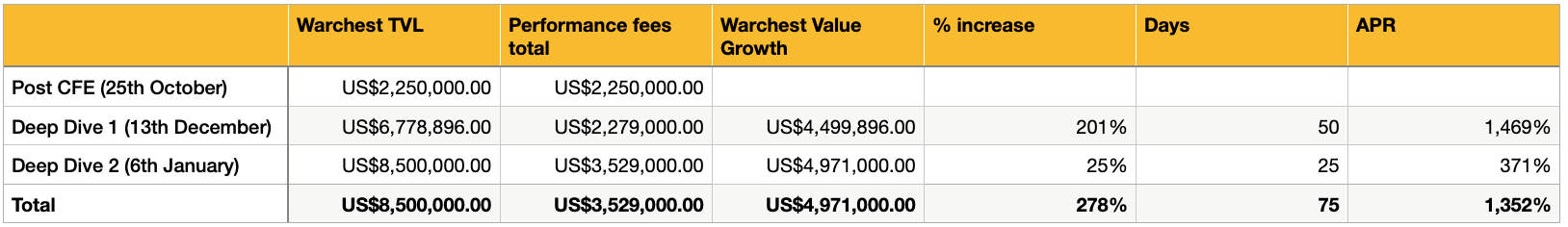

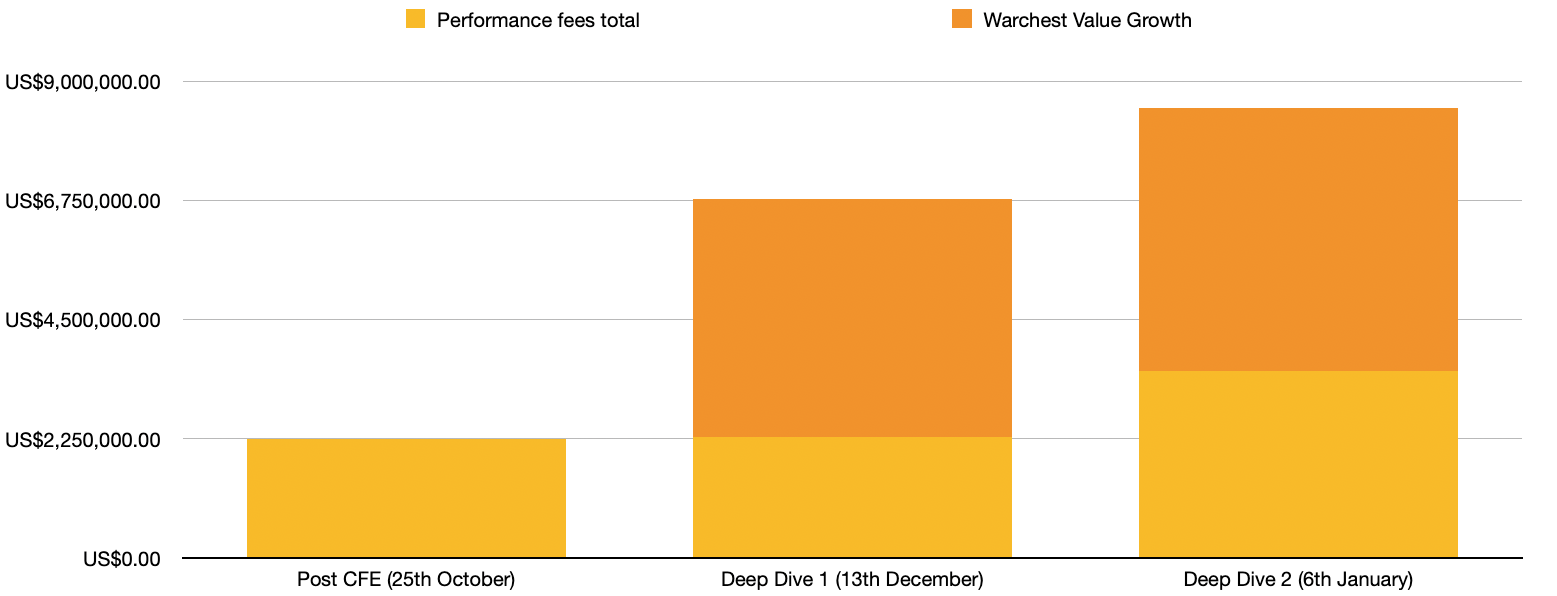

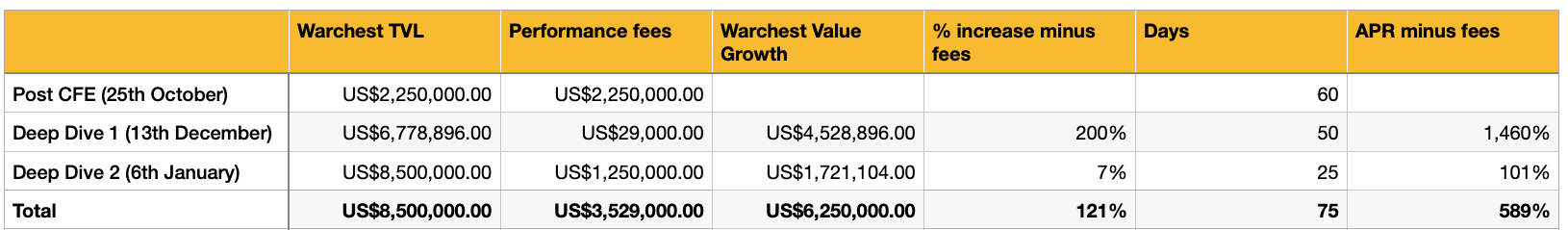

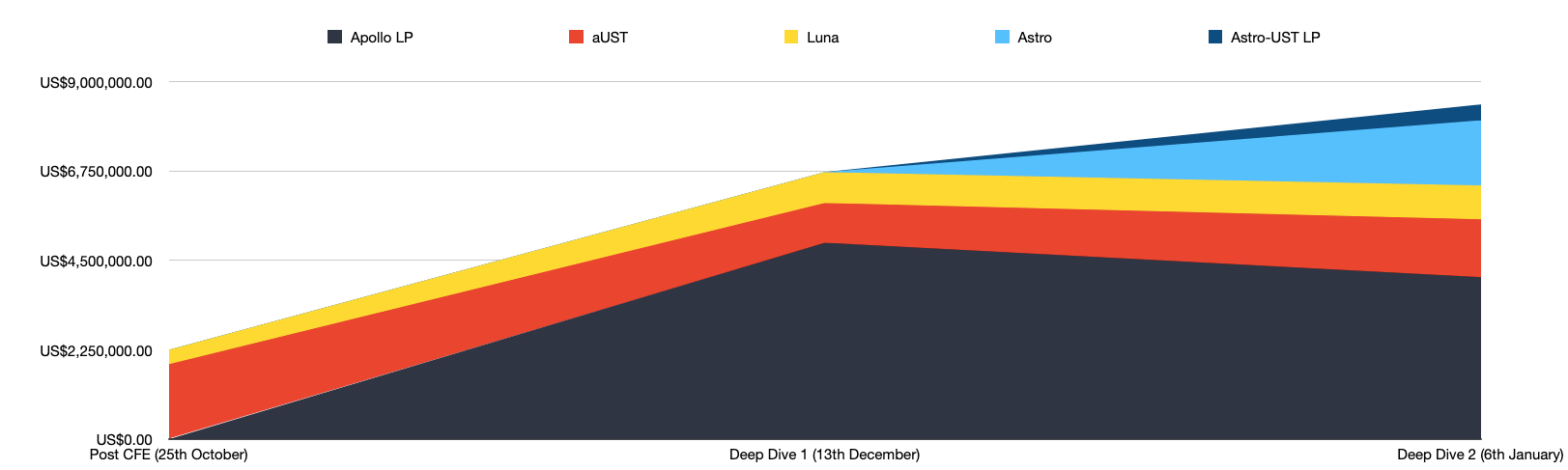

We last did a deep dive into the Warchest’s performance on the 13th of December, where the Warchest had a TVL of $6.6m, with over 70% of this being Apollo-UST LP. In the last 25 days the Apollo Warchest value has increased by roughly $1.7m, a gain of 25%, which translates as over 370% APR.

In the 75 days since the end of the CFE, the Apollo Warchest has grown over 275% (1352% APR).

Even after discounting Apollo’s performance fees, the Apollo Warchest has seen impressive growth of over 120%, averaging almost 600% APR.

While much of this growth came from the increase in price of the Apollo LP and from farming Astro tokens, we are already preparing to make the most of a number of other farming opportunities coming to Terra in the near future, as well as leveraging our current assets for yield to maintain the Warchest’s high growth trajectory.

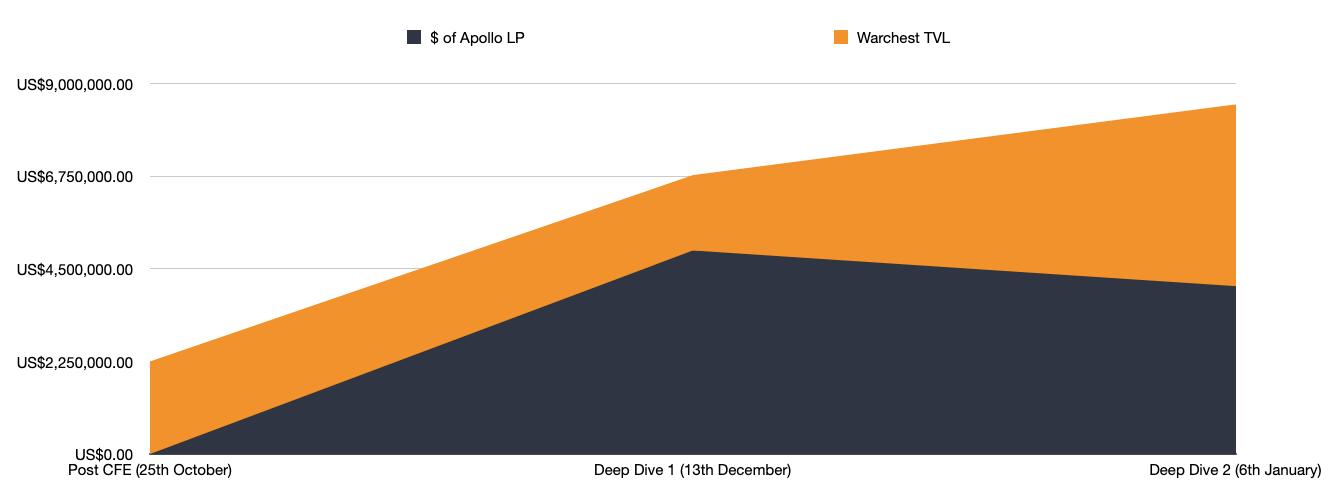

Since our last deep dive, the Apollo Warchest has been increasingly diversified, with the percentage of Apollo-UST LP being reduced from over 70% to less than 50% of the total Warchest value, meaning Apollo tokens (in the form of Apollo LP), currently make up less than 25% of the total Warchest value.

This is predominantly due to the introduction of over 1m Astro tokens, as well as around $400k Astro-UST LP to the Warchest, which has helped to diversify holdings and aligns with our long term goals.

Overall what this means is that since the end of the CFE, Apollo has been able to grow the Warchest value by 280% in 75 days, and by over 120% when discounting performance fees, while improving Warchest diversification.

While this is still early in the bootstrapping phase for Apollo DAO, we believe this highlights a number of the advantages that a decentralized hedge fund can offer. It has also demonstrated Apollo DAO’s ability to leverage our current token holdings to generate returns, without having to liquidate any of our assets.

One of the major upcoming changes for Apollo DAO will be the introduction of our Governance staking and the zApollo token.

zApollo and Warchest Governance

Apollo governance staking will go live within Q1 of ‘22 and will have a similar locked governance staking to Curve and Astroport, meaning the longer users lock, the more rewards and governance power they receive in return.

zApollo (vote locked Apollo) stakers will be able direct the flow of capital from the Warchest through proposals and voting. Whether that is to invest, farm, arbitrage or buy backs off Apollo tokens - or some combination of the above, as well as additional options that are not yet possible - the aim will to be continually increase the Warchest TVL.

The advantage that Apollo DAO vs traditional Hedge Funds is our ability to harness the knowledge and expertise of our community to understand and monitor opportunity in a far greater quantity than would otherwise be possible. In the fast moving crypto space, this is becoming increasingly important, with certain sectors vastly outperforming others. We have already seen the benefits of this in action, with our community opening a number of doors to some great opportunities and we are currently laying the groundwork for the Apollo community to be able to become more involved in the development of Apollo DAO.

Apollo has already been able to bootstrap the Warchest to over $8m value, with zero direct investment. Instead roughly half of this has come from performance fees on our protocols in return for Apollo tokens; with the remainder coming from the growth in value of the Warchest assets and from farming.

Apollo Meta Governance

The Apollo Warchest fund will continue to leverage funds to generate returns and further diversify This in turn will also enhance the Meta Governance capabilities of Apollo DAO.

We will go into much more detail on Apollo ambitious around meta governance both for Terra and the wider crypto ecosystem in a future article. However looking at the example of Astro highlights our early plans for this.

Based on current market caps, for every $1 of Apollo in circulation, there is 8c of Astro in the Warchest. Once vxAstro goes live, Apollo stakers will be able to decide how best to utilise these Astro tokens. Astro is just the first example and Apollo DAO plans to be an active governance participant across Terra.

The Warchest and the Floor

While currently the Warchest is in a high growth “bootstrapping phase, the mid to long term aim for the Warchest is to serve as both an investment vehicle for Apollo DAO as well as a mechanism to create a “floor price” for the Apollo token.

Due to the illiquidity of some investments (such as seed rounds) which can cause some challenges to maintaining a price floor (as liquidity may not be available when most needed); early on Apollo will focus will be growing the Warchest exponentially through investments, making the most of its relatively small size, and as it grows, transitioning to more of a farming focus in order to maintain liquidity and create a solid price floor.

Stage 1:

- Bootstrap Warchest through performance fees on our DeFi protocols.

- Utilise the Apollo teams contacts to secure private round deals in the Terra ecosystem to grow the Warchest exponentially.

- Accumulate Apollo LP and use this to farm $Astro + $Apollo tokens.

- Use funds to accumulate $Astro, $Mars and a number of other Terra Governance tokens through their respective lock drops, farming, seed investments etc,

- Token swaps with other projects.

- Grow the meta-governance power of Apollo

Stage 2:

- Accumulate $Apollo LP, Luna/UST LP and potentially $Astro through a bonding mechanism

- Utilise a mechanism like Convex/Yearn backscratcher to accumulate governance power, for a range of protocols.

- Invest/incubate new Terra projects

- Decentralise the Warchest research and investment decisions as it continues to grow.

Stage 3:

- Use a small percentage of capital for venture bets and continue to incubate ecosystem projects

- Move the majority of Warchest funds to more liquid farming opportunities and focus on growing the Warchest linearly.

- Increase the amount of aUST and other stables in the Warchest in order to increase the “risk free value”

- Use the $Apollo LP and liquid UST to create a $Apollo price floor.

One of the reasons we are so keen to create a solid and perpetually increasing price floor, is that it will enable long term Apollo holders and community members to access a percentage of

the liquidity of their Apollo tokens at a “risk free value”, without having to sell their capital.

Apollo Going Forward

The plan is for Apollo token incentives to last for 3 years, until all 100m tokens have been distributed, in which time Apollo DAO will become fully self-sufficient. In short we need to ensure that we have fully bootstrapped the Warchest, there is enough Apollo liquidity without incentives and there is sufficient decentralized leadership to manage Apollo DAO. Apollo will also enter a deflationary period at this stage as the warchest will continue to generate yield and accumulate Apollo tokens with zero new emissions.

If you want more information on the inflationary/deflationary nature of Apollo tokens, search “inflationary phase” in our previous Deep Dive.

Brought to you by the Apollo Team

Join our Discord

Join our Telegram

Follow us on Twitter