veApollo Staking: What to Expect

veApollo is the governance and yield sharing token for Apollo DAO. This post aims to provide all the required information and answer any questions you may have ahead of the launch.

veApollo will have a number of benefits from launch, with plans to continually add new additional benefits over time. Not only will veApollo give holders the decision making power over Apollo’s DeFi products, but will also provide control of Apollo’s Warchest deployment and meta governance power. In return for this, veApollo stakers will be incentivised with ongoing yield.

In this post we will cover:

- The benefits of veApollo

- Why would you lock your Apollo for up to 2 years?

- How veApollo Works

- How veApollo Meta Governance will work

- veApollo Future Benefits

veApollo Benefits

1. Management of Apollo’s DeFi Protocols

Apollo DAO has already created a range of DeFi products that have begun to form our holistic asset management platform. These include Apollo Vaults, Safe and Farmers’ Market, which will increasingly be amalgamated over time and combined with our future launches, such as leveraged yield farming and our Convex model.

These protocols have so far bootstrapped the Warchest with nearly $5m in fees over the last 6 months and have proved to be great tools to manage the Warchest funds. veApollo stakers will be in charge of how best to manage these current and Apollo's future products; whether to focus on continuing to use these products to bootstrap the Warchest, or to focus on minimizing fees and attracting the largest amount of TVL possible, or something in between.

veApollo stakers will be able to decide on:

- Fees and Apollo Rewards for Apollo Vaults

- Management and Monetization of Apollo Safe

- Management of the Convex model, including Apollo rewards

- Where to best focus development resources for future growth

Over time veApollo stakers will gradually be given complete control of Apollo products and how best to utilise them in order to generate revenue for Apollo DAO, as well as providing the best experience for our users. It is still very early on Apollo DAO’s journey and veApollo stakers will be the ones to shape that journey.

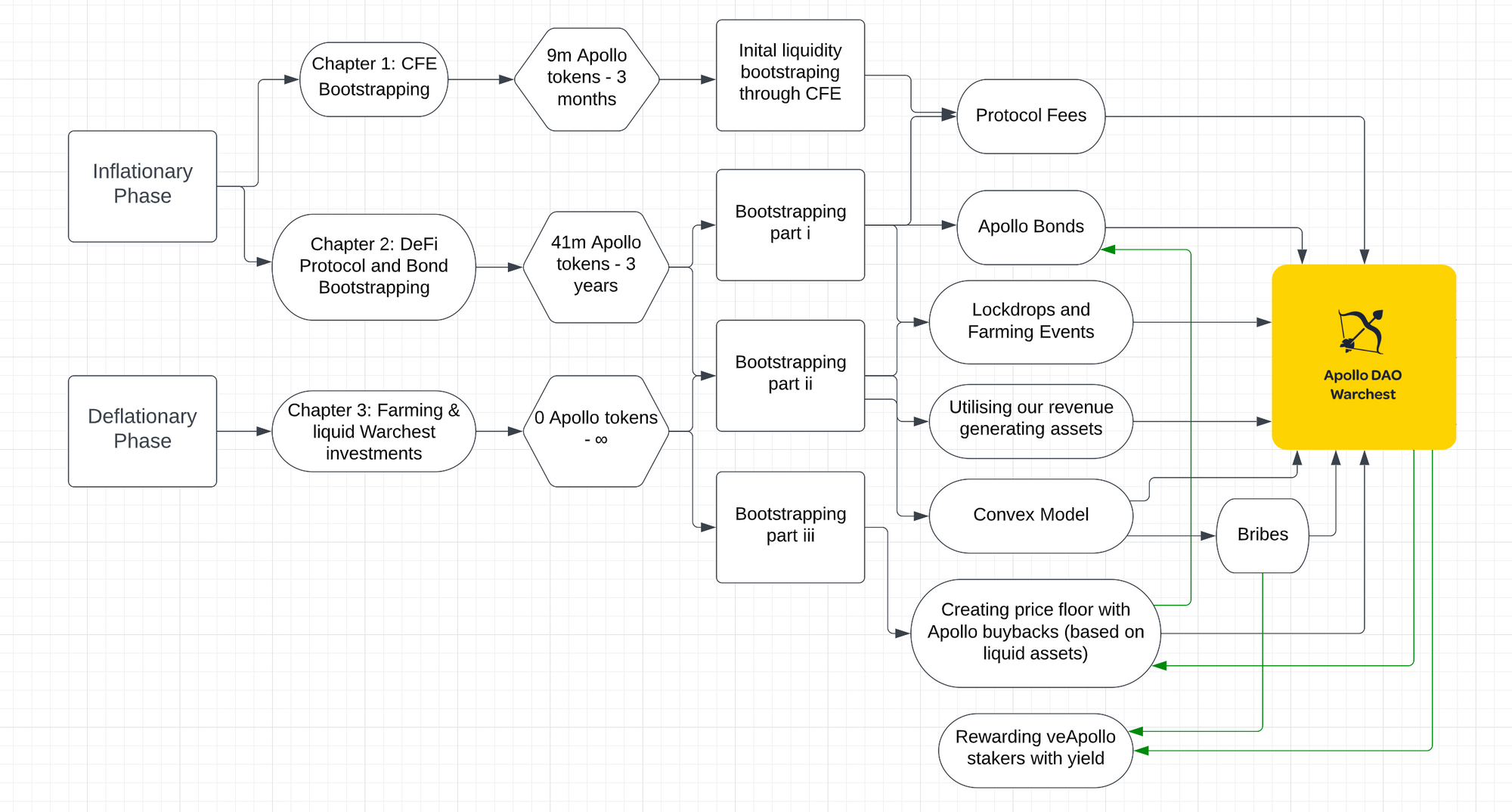

Apollo will be distributing 50% of the total $Apollo supply to users of our products, who are well placed to understand how best to continue to improve and enhance Apollo’s offerings. While still early on, Apollo’s DeFi protocols are already achieving annual revenues in excess of $2m/year, and by making good governance decisions this will directly lead to increased revenues for Apollo DAO and therefore greater rewards for veApollo stakers.

2. Management and deployment of the Apollo Warchest

One of the major novel features of Apollo DAO is our actively managed Warchest, which has managed to so far accumulate over $13m worth of assets; https://articles.apollo.farm/apollo-daos-deep-dive-iii/.

veApollo stakers will be in charge of governance decisions for the Warchest, which will range from:

- Where best to deploy or invest capital,

- Any token swaps that Apollo perform with other symbiotic projects,

- How to maximise the yield of current holdings,

- When to and how to reward veApollo stakers with Warchest yield.

The Warchest will continue to grow overtime, but right from the start, being able to govern and manage a $13m Warchest provides veApollo stakers a large amount of responsibility, but also potential reward. The Warchest is already earning over $6m/year in yield and will provide long term, sustainable rewards for veApollo stakers if it is well managed.

As well as sustainable yield, the Warchest also provides Meta Governance power over a number of protocols. This is done by utilizing the Warchest’s holdings of Governance tokens to vote on proposals for other DeFi platforms.

3. Meta Governance

Apollo’s aim through meta governance is to help support the decentralisation of other protocols, as well as support proposals that will benefit the growth of Apollo DAO and the overall ecosystem. As Apollo DAO grows this governance power over time, it will be able to increasingly shape the ecosystem and benefit from this large amounts of decision making power.

So far the Warchest has Meta Governance power over protocols including:

- Astroport

- Mars

- Prism

- Kinetic

- Stader

- As well as others in the near future (YFD etc.)

Apollo will also be launching our own Convex model in the near future. While it is impossible to tell how much Astro this will attract, the Convex model has proven to be an extremely effective way for a treasury to gain a huge amount of governance power. All of the governance power for the Astro that Apollo attracts (and max locks as vxAstro), will be controlled by veApollo stakers. This voting power can either be used directly by veApollo stakers, or they will be able to receive “bribes” (additional rewards), for directing this voting power in a certain way.

Votium, a bribing platform designed to facilitate the “borrowing” of CRV voting power has made over $150m in revenue in the last 7 months, demonstrating the demand for veCRV voting power, something we are likely to see echoed by Astroport.

All of Apollo’s meta governance voting will be controlled directly and proportionally by veApollo stakers, for example if there is 5m vxAstro locked in the Warchest and 10m veApollo, every 1 veApollo would effectively control 0.5 vxAstro, as well as all the other governance tokens. Also by earning yield on these governance tokens, Apollo’s governance power will continue to grow over time, even after all 100m Apollo tokens have been distributed.

We already know of a “Bribing Platform'' that will be coming to Terra in the near future, where Apollo holders will be able to earn additional rewards on their tokens as they will be able to receive bribes for their meta governance power. While Astroport governance is likely to be the most valuable early on, we believe we will see an increasing demand for meta governance for a whole range of DeFi platforms on Terra.

We will go into more detail on the power of meta governance and how it will work with veApollo later on in this post, but overall it can either be used directly by veApollo stakers to help shape the ecosystem, or can be used to gain additional rewards for stakers through bribes.

4. Sustainable yield

The yield for veApollo will initially come from Apollo yield farming rewards. However the aim of Apollo DAO is to create a large number of diversified revenue streams all directed to growing the Warchest, which will then be able to sustainably reward veApollo stakers indefinitely, with exactly how this is executed decided by veApollo stakers.

So far Apollo has created a number of revenue streams including protocol fees and Warchest yield, but has plans to grow many more over time. The aim will be to continue to diversify the revenue streams to protect against some of the crypto volatility.

5. Additional benefits in the Future

As well as these initial features, we will continue to add new features and benefits to veApollo staking over time, such as the ability to boost your Apollo yield on our vaults being added in the future. We will also continue to enhance the functionality of Apollo’s meta governance to make this a smooth and rewarding process, as we believe this is one of the areas that will become increasingly attractive on Terra over time.

As Apollo releases new features and products we aim to continue to enhance the functionality of veApollo over time.

Why would you Lock your Apollo for up to 2 years?

By locking Apollo for veApollo you not only gain governance power over how Apollo can best maximise revenues and profits for the DAO, but you will also receive a constant and an increasingly sustainable yield source that benefits from the growth of Terra and the wider crypto ecosystem.

This yield will initially come from Apollo yield farming rewards and gradually switching to receiving yield from the Warchest, any revenue from bribes and profits directly from Apollo’s products over time.

While two years is a long time in DeFi and Apollo has only been out for 6 months, we have already begun laying the groundwork for long term sustainable yield for the Apollo token, with annual revenues from our Vaults and Warchest already generating over $10m/year. These are just two of our initial revenue streams and we have a lot of new features and products coming, as well as ongoing enhancements for our current offerings. But this alone could already offer a sustainable return of over 30% APR for veApollo stakers.

However Apollo still has over two years of Apollo token incentives, providing time to create new, as well as improve existing revenue streams and allow the Warchest to continue to compound and grow in value, providing a stronger base for sustainable returns in the future.

The Apollo Warchest has been focused predominantly on accumulating revenue generating assets, that will be able to provide a permanent yield to the Warchest, which can be passed on to veApollo stakers. As long as Luna, Astroport, Mars, aUST, Kinetic, Prism, Stader (and more in the near future) keep generating yield and revenues, then there will be continued yield for veApollo stakers.

Exactly how much and how it is distributed will be up to governance, who will decide how best to deploy funds, which products to focus on and what percentages of Warchest yield should be compounded vs provided to veApollo stakers.

While being required to lock up Apollo tokens for Governance power and yield may not suit all users, we have plans to create additional ways to earn yield on Apollo in the near future without locking. This will include using Apollo in lending platforms, bribing platforms, Bond platforms and even releasing a Convex model for veApollo. However by having time locked Governance, this will help enable Apollo DAO to become fully decentralised over time, while maintaining a long term governance mindset.

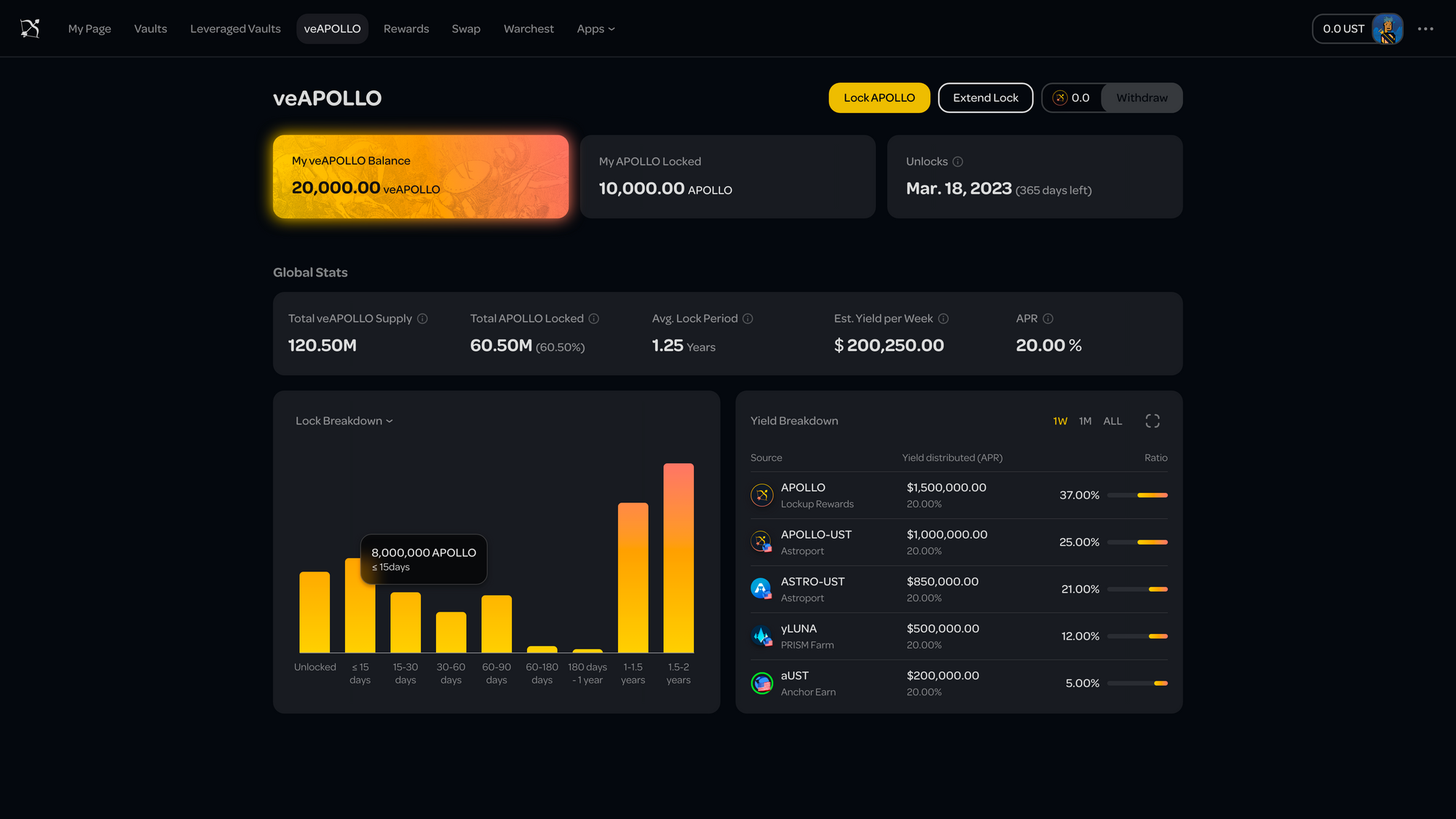

How veApollo Works

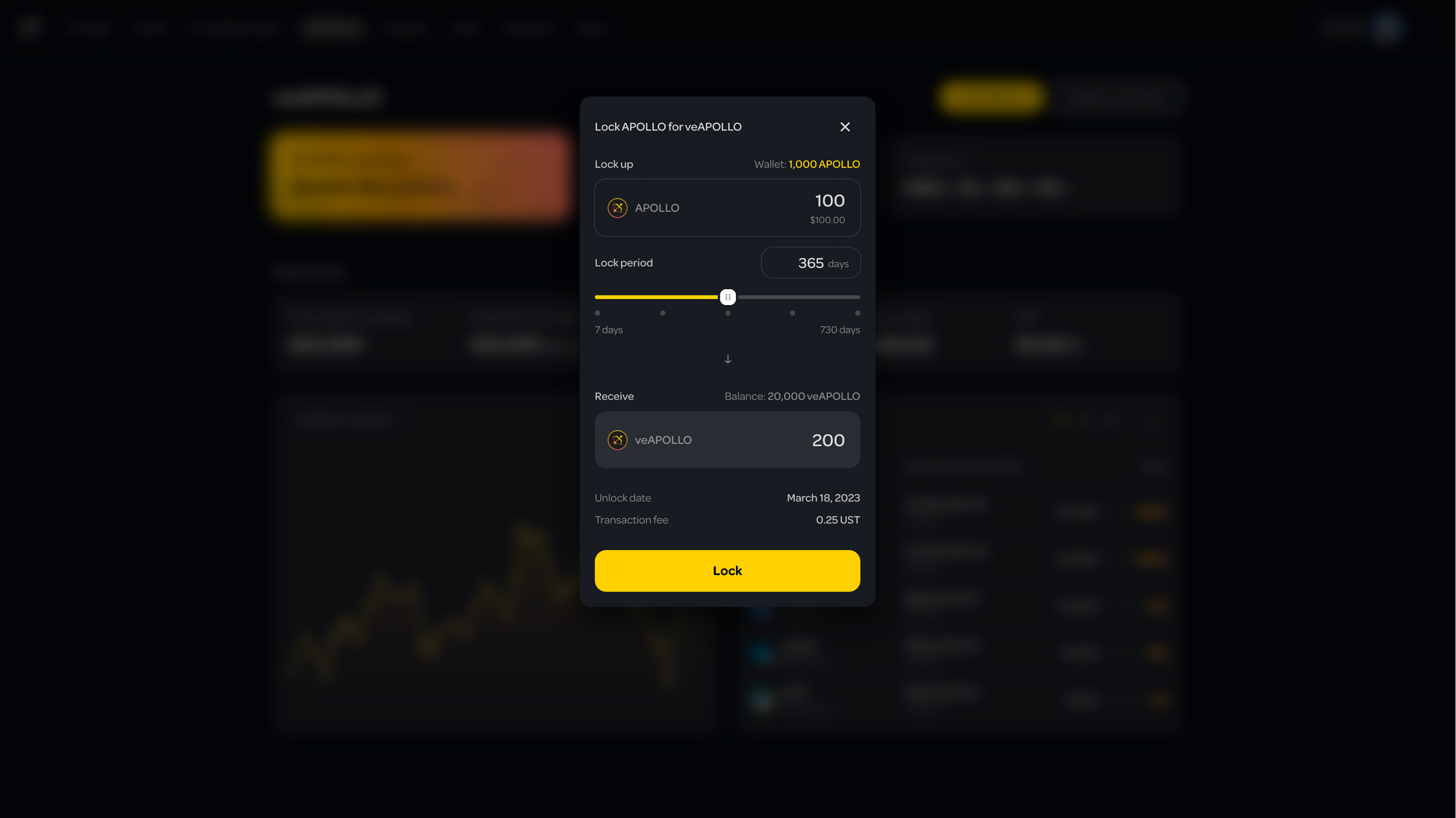

- In order to get veApollo you will need to lock up Apollo tokens for 1 week to 2 years, and will receive proportionally more veApollo depending on how long you lock for, meaning more voting power and a higher yield.

- Your veApollo balance will decrease linearly over time unless you re-lock it.

- You will be able to unlock all of the Apollo you deposited when your lock period ends.

- Staking rewards are earned as soon as you start staking, but will start being paid out at the beginning of the following week.

- The locking of Apollo tokens can’t be undone.

One of the main reasons we decided to go with a veStaking Model is to align the DAO on long term decision making for the Warchest and Apollo products. By providing proportionally more voting power to users who lock the longest, it helps protect against governance takeovers and a “short term profit” mindset, while rewarding our long term supporters.

How veApollo Meta Governance will work

All meta governance decisions will be made by veApollo stakers and we will continue to work on making this an easy, accessible and rewarding process. The image below shows an early design of Apollo’s Gauges, which will allow veApollo stakers to direct their Astro voting power either to a specific vault, or they can delegate it for bribes and receive additional rewards for not using their voting power. We are also working on making this a completely automated process and will be releasing more information on this with our Convex model.

Over time we believe that the demand governance power over Astro emissions could exceed what we currently see for CRV. While we expect Astroport governance to be extremely lucrative, we also believe that governance for platforms like Mars and others will become increasingly valuable over time.We believe that our meta governance platform alone will generate strong and consistent revenues for veApollo stakers.

veApollo Future Benefits

veApollo has been designed with flexibility, so that it can continue to evolve over time. While to begin with the yield for veApollo will come from Apollo Farming rewards, the ‘fee collector” contract has been designed so that over a one week period it can collect all the fees generated by Apollo DAO and then distribute them the following week.

While this means that there will be a one week delay between locking your Apollo tokens for veApollo and starting to receive rewards, it also makes it far easier in the future to direct profits from different areas of Apollo DAO straight to the veApollo stakers. Whether this is revenue from the Vaults, profits from Bribes, or yield from the Warchest, it can all easily be directed to reward veApollo stakers.

We already have a number of plans to continue enhancing the utility of veApollo over time, such as introducing the boosting of Apollo rewards on our Vaults, similar to Astro “boosties” and “yApollo” that would provide additional rewards and benefits to veApollo stakers, and will also continually work with the community on further enhancing this utility.

Conclusion

Overall veApollo is primarily designed as a way to align governance with the long term, sustainable success of Apollo DAO. In return for this support veApollo stakers will receive a constant source of yield that will be increasingly designed to last indefinitely. We believe the value of meta governance will continue to grow and veApollo will be well placed to make the most of this, rewarding our stakers. Beyond this, we want to continue to develop the functionality of veApollo, further integrating it into our future products, providing additional benefits to our stakers.

The more Apollo grows, the more the yield sources can be diversified, initially focused on Terra, but also branching out for cross-chain opportunities and potentially even opportunities unrelated to crypto in the future.

While we believe there are a huge amount of benefits to the veStaking Model, especially in relation to governance (and our aim is to reward our longest term supporters), we do appreciate that a ve Model may not suit every users and will therefore continue to increase yield opportunities for Apollo tokens that do not require them to be locked.

veApollo marks a major step towards the decentralisation of Apollo DAO and we are very excited to be launching it very soon, as it will allow a far wider range of views and ideas to be discussed and implemented through governance.

Join our Discord

Join our Telegram

Follow us on Twitter