Apollo DAO’s Warchest Deep Dive III

Welcome to the Warchest Deep Dive III. In our last Deep Dive into the Apollo Warchest, roughly two months ago, we explored Apollo DAO as a Decentralized Hedge Fund and the performance so far.

In this post we will be exploring:

- The Warchest performance over the last two months,

- Current revenue streams of the Warchest

- The Future of the Apollo Warchest

- Warchest Model vs Fee Distribution

The Apollo Warchest holds a number of highly volatile crypto assets, so these values will be constantly changing, but this article aims to provide a snapshot in time of the Warchest performance so far. For an up to date view of the Apollo Warchest, please check: https://app.apollo.farm/warchest.

The Apollo Warchest

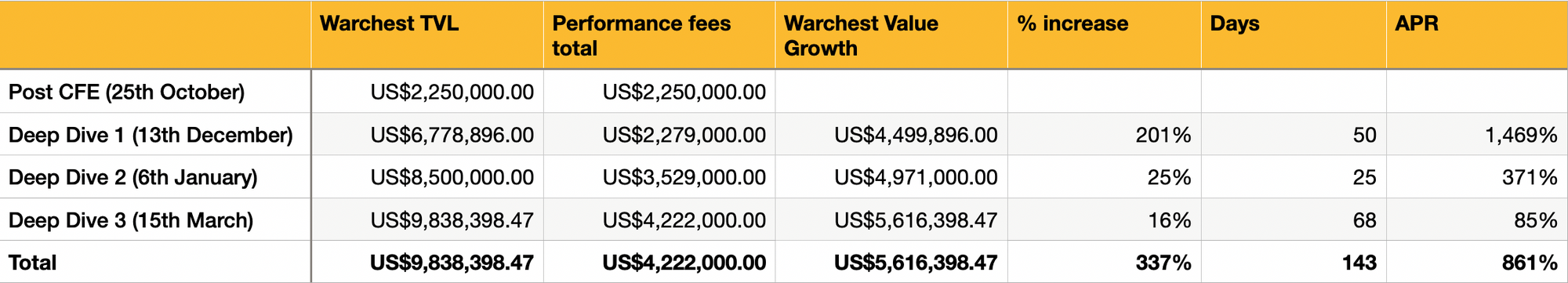

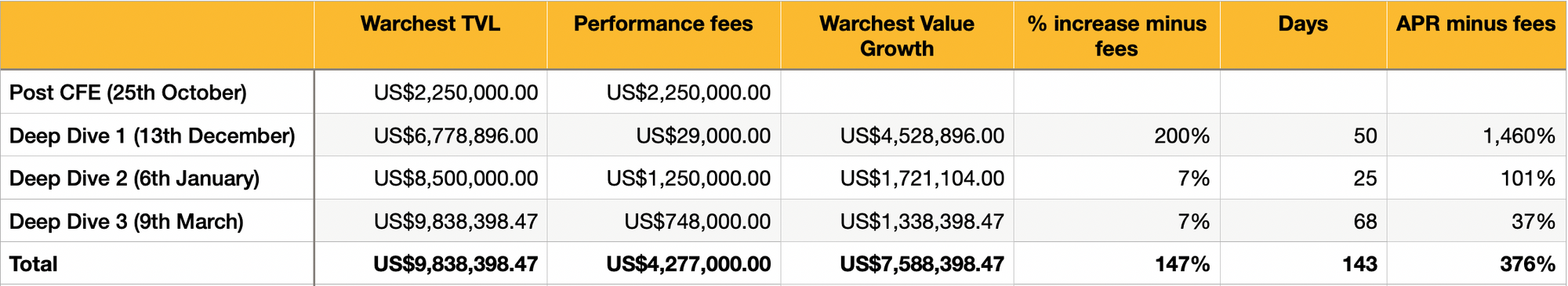

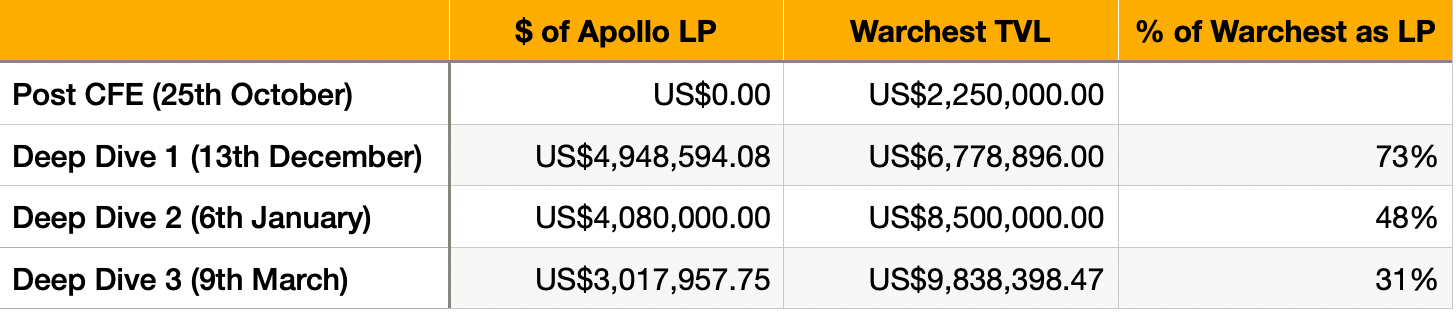

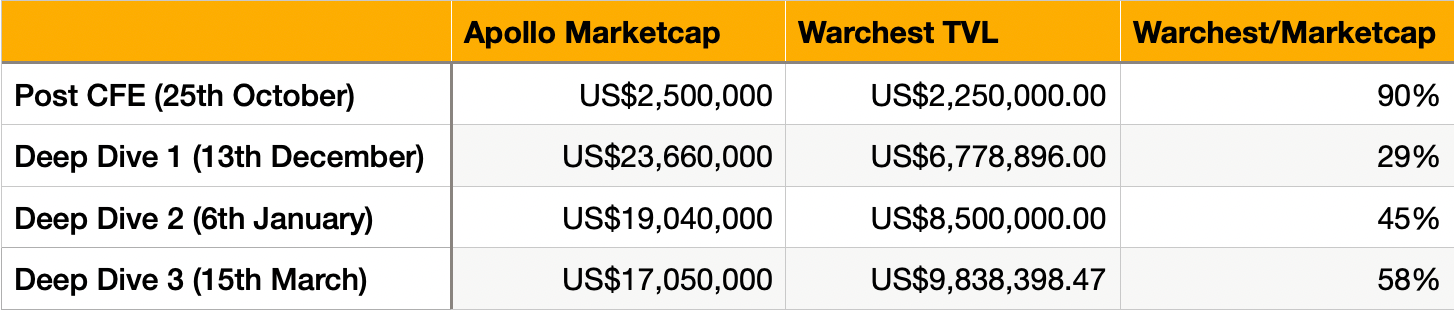

The Apollo Warchest has been active since the end of our CFE 143 days ago and has reached a total value of over $9.8m, which represents a 337% growth or 861% APR since inception.

As you can see from the chart above a large percentage of this growth came at the early stages of Apollo’s launch, where the Warchest benefited from the price growth of Apollo LP and the ability to utilize this LP in the Astroport Lockdrop. However even in this most recent period over just over two months since our last Deep Dive, the Warchest has increased by 16% (a growth rate of 85% APR), against a backdrop of broader sell offs across the crypto market.

The Warchest’s method of accumulation so far has been relatively simple:

- Make a small number of high conviction plays based on fundamentals,

- DCAing into these assets over time irrespective of the market,

- Utilizing our holdings to acquire more assets through farming and Lockdrops.

Our two main high conviction bets so far have been:

- The growth of the Terra Ecosystem: When we started building Apollo DAO, there were less than a handful of dApps on the network and the price of Luna had plunged from over $20 to around $5, with serious questions being raised about the ability of UST to maintain it’s peg. While such questions are still prevalent, it would be hard to argue that the Terra ecosystem is not in a far stronger position now.

- The fee generation potential of Astroport: With the high volumes seen by TerraSwap and over $1b locked in Astroport since launch, combined with a number of innovative solutions that Astroport was bringing to DEXs on Terra, we were (and still are), extremely confident in Astroport’s ability to provide high, yet sustainable returns based on fees. This also combines well with a number of other benefits, such as “Boosties” that will be offered in the near future.

Combined with our ability to enter a number of farming events/Lockdrops, including: Astroport, Stader, Mars and Prism, the Apollo Warchest has continued to grow despite broader crypto market conditions.

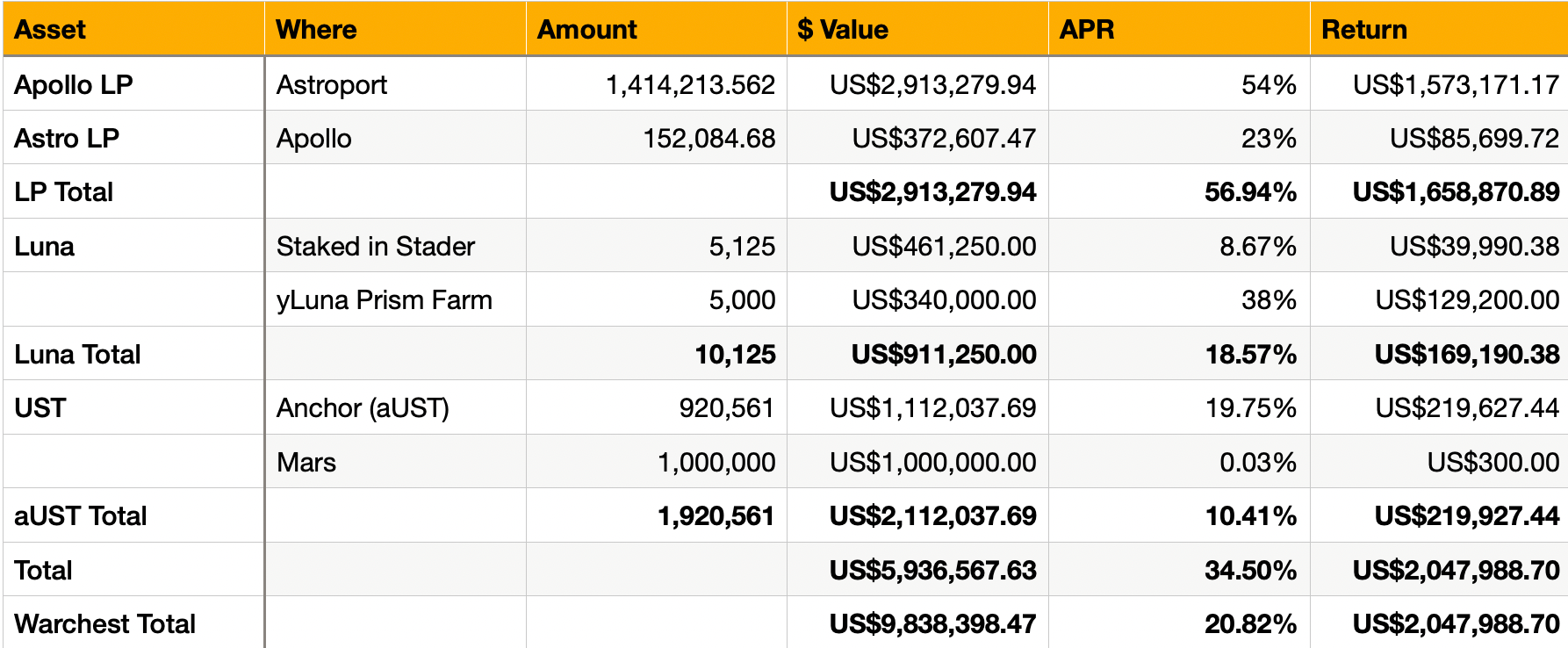

Even when removing performance fees from the Apollo Warchest performance so far (which are less scalable than the Warchest value growth), the Warchest has maintained an APR of 37% over the last 2 months.

One of the main risks for the Warchest that was highlighted in previous Deep Dives, was the fact that our Apollo LP made up a majority of the Warchest value, which caused a large amount of reflexivity between the Apollo price and the Warchest value. This Apollo LP provides a number of significant benefits, from facilitating indefinite trading of the Apollo tokens, while also allowing the Warchest to farm large amounts of Astro and Apollo tokens. The other main benefit of our Apollo LP holdings are that the lower the Apollo token price, the more Apollo tokens that are taken out of circulation by this LP; at current prices around 8% of the circulating Apollo is held in the Warchest owned liquidity.

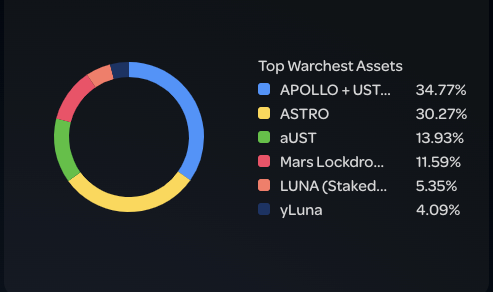

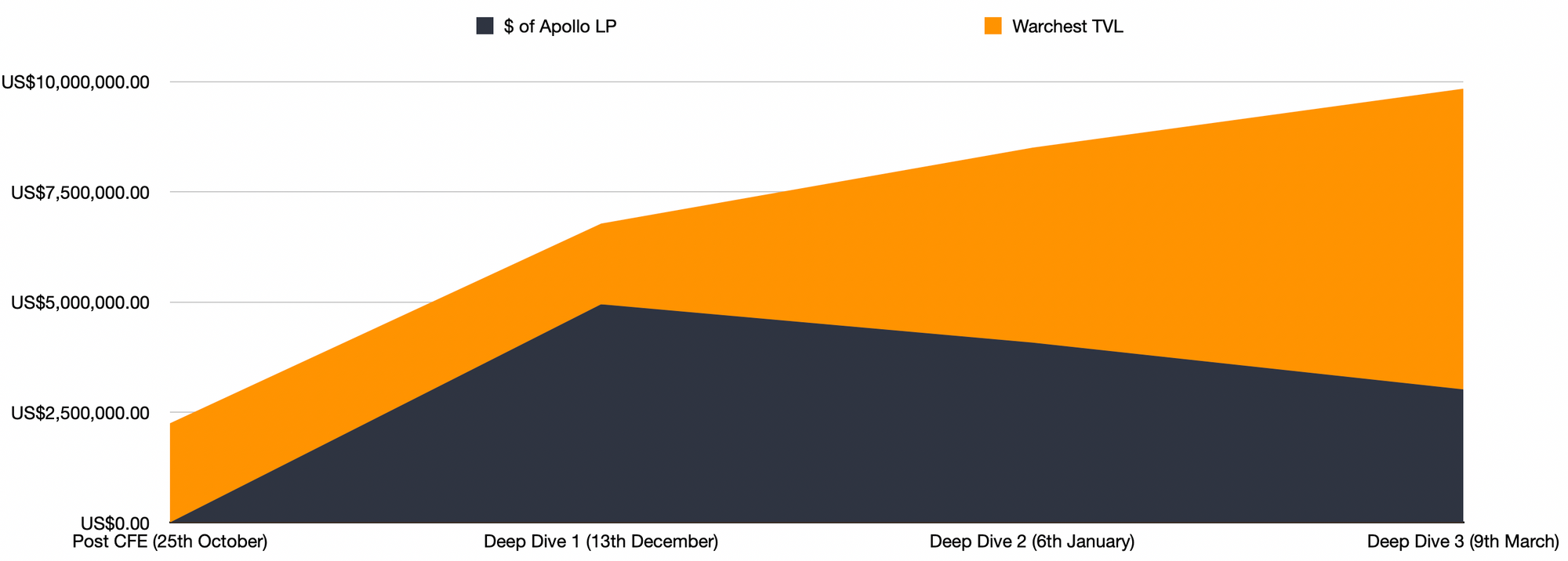

However to combat this reflexivity; over the last (nearly) 5 months, the Warchest has continued to diversify assets, with Apollo LP making up 75% of the value of the Warchest on our first Deep Dive and now accounting for roughly 33%, with nearly 70% of the Warchest value now in less correlated assets, such as Luna, Astro, UST and Mars.

This is due to two main factors since our previous Deep Dives; an increased value of the Warchest, and a reduction in the token price of the Apollo token. This now provides a floor for much more sustainable growth of the Warchest, due to a variety of assets held and the ability to earn further revenue from these holdings.

The Apollo Warchest’s "DCAing" method of accumulating assets has also taken full advantage of the price reductions we have seen both on Luna and Astro (although both of these have recovered most of these discounts now), but we believe this highlights the effectiveness of this method.

Over the last two months, the Warchest has increased holding of:

- UST by $730k,

- Astro by 250k ($450k)

- Luna by 473 ($42k)

In this time we have also added:

- 298K Mars ($200k)

- 7k Prism ($3.5k)

- 146k Apollo ($149k)

In terms of the Warchest accumulating Apollo tokens, the primary benefit is that the more Apollo held by the Warchest, the less Apollo circulating and while current holdings of Apollo (not including in LP) only represent 0.8% of circulating supply, the aim is to continue to increase this over time. Combined with a max cap of 100m Apollo, the more Apollo that can be accumulated by the Warchest, the more governance power each Apollo in circulation will have.

These Apollo holdings will also provide our token holders several avenues of utility once governance goes live. These include to ability to:

- Stake Apollo for veApollo, accumulating more of the Apollo supply.

- Conducting token swaps with other protocols that are aligned with Apollo DAO, or provide additional revenue while diversifying the Warchest holdings.

- Create additional Apollo LP, which can then be used to Farm more Astro and Apollo tokens.

- Bonding of these Apollo tokens for Apollo LP or additional assets.

Revenue Streams

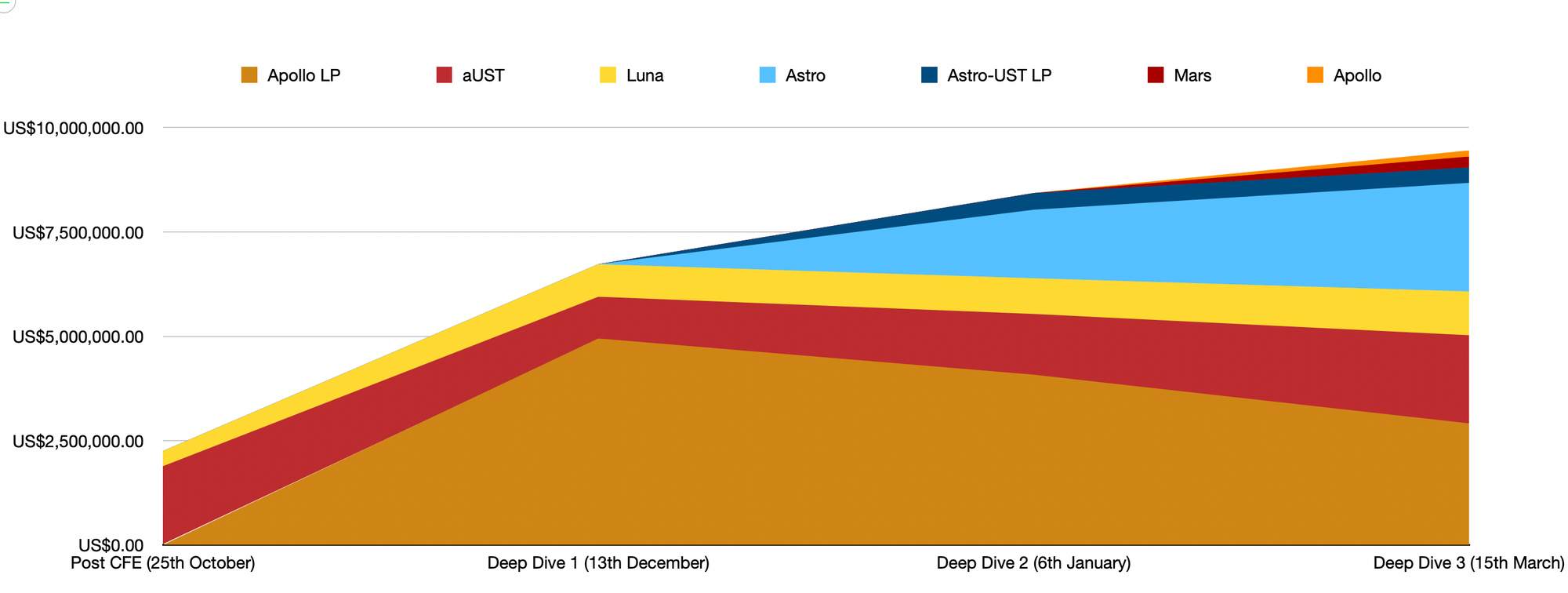

So far the two main Bootstrapping methods for the Apollo Warchest have been performance fees, both from our Vaults and Farmers’ Market, as well as farming opportunities, such as Lockdrops.

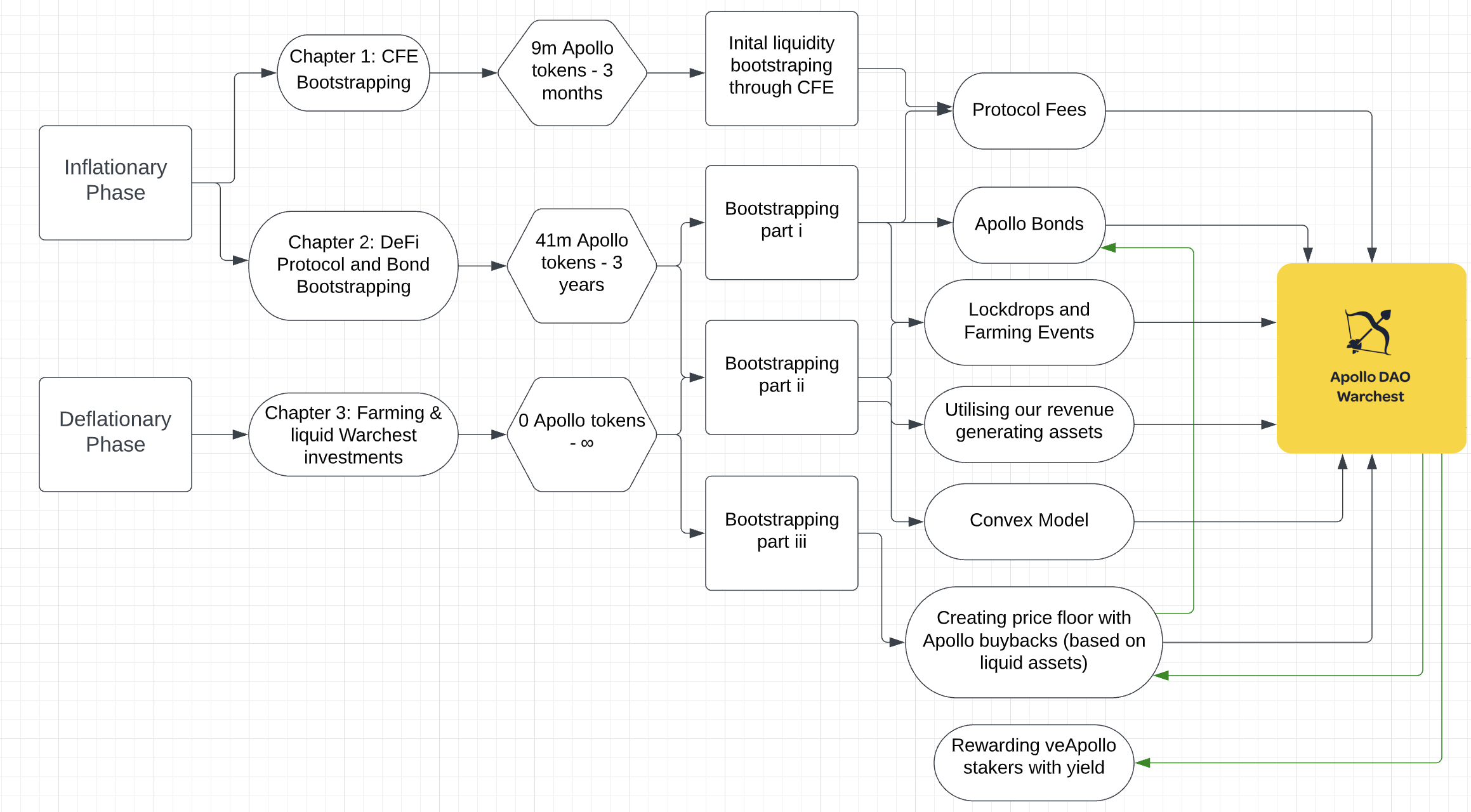

In our first Deep Dive into the Warchest, we highlighted three main chapters for the Apollo Warchest, which fit within our Inflationary and Deflationary Phases of Apollo DAO;

- CFE Bootstrapping (9m Apollo tokens) - 3 months

- DeFi Protocol and Bond Bootstrapping (41m Apollo tokens) - 3 years

- Liquid Warchest investments used to create a “floor price” of Apollo - ∞

The inflationary phase will last a total of 3 years, until all 100m Apollo tokens have been distributed, with currently ~17% of these tokens distributed so far. Chapter 2 (DeFi Protocol and Bond Bootstrapping) can be split further into “Bootstrapping part i” and “Bootstrapping part ii”, although these will have significant overlap.

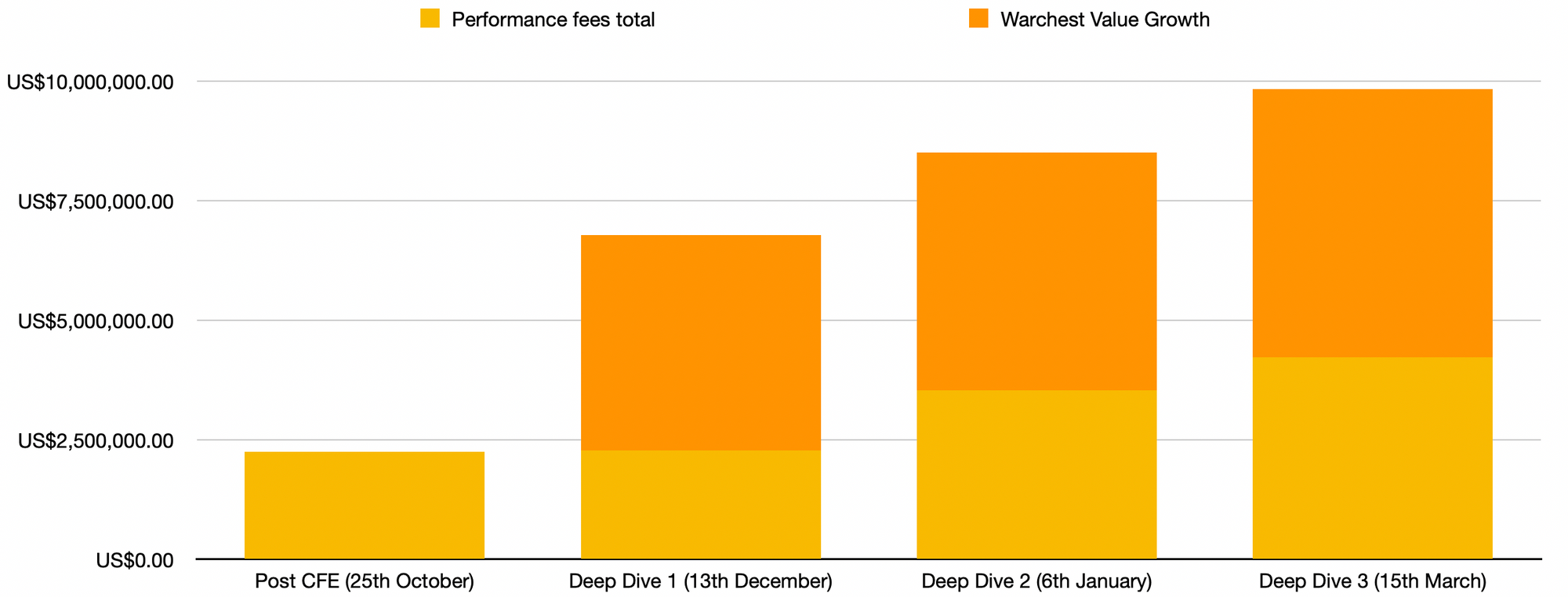

This diagram is not exhaustive and is just to highlight both new ways in which the Warchest will be able to continue generating revenue over time and the overlapping nature of these Phases. This is meant purely as a representation of some of the potential, as exactly how this will be executed will be up to veApollo stakers and governance once launched.

While “Bootstrapping part i” is ongoing, with revenue coming through fees, Bonds (coming soon) and new Lockdrop opportunities (such as the upcoming Kinetic Lockdrop and many more to come); with the upcoming launch of vxAstro, our accumulation of Prism tokens and deployment into xMars, we are beginning to simultaneously enter “Bootstrapping part ii”, where the focus is also on utilising our revenue generating assets.

Apollo’s Warchest assets are currently generating over $2m in value per year, or 20% APR, although many of these are auto compounding so this will be higher over a year period. However, currently only 60% of our assets are revenue generating, with many of our major holdings yet to introduce staking or fee sharing, thus we expect the rate to grow over time.

Beyond fee sharing we are also very bullish on the growth potential of Luna and the Terra ecosystem, however we have not taken into consideration any future price movement in this assessment.

The Future of the Apollo Warchest

While the majority of this article is based on current Warchest holdings and performance so far, we will also take this opportunity to look ahead on what is to come for the Warchest in the near future. These are forward looking statements and not to be taken as investment advice.

1. Potential Future Revenue Streams from Current Assets:

Based on our conservative assumptions for other assets that we expect to introduce staking/fee sharing and protocols such as Mars (#raisethecaps), we believe the revenue generation will be considerably higher than the current return on Warchest assets. Based on these estimates, we believe it is possible to achieve rates of 33% APR or higher.

2. Convex on Terra:

“Convex on Terra” has become a hot topic in recent weeks with the announcement of the upcoming Retrograde and Reactor projects and the upcoming “Astro Wars” is something we are really excited to see play out with the release of vxAstro.

Astoport has already proven to be a dominant force on Terra and a revenue generating machine, with daily volumes often exceeding $300m/day. While the recent price action of Astro has caught the attention of many, Apollo DAO has been preparing for the Astro wars since before the launch of Astroport at the end of last year. Our first step towards this was getting Apollo LP listed as one of the tokens in the Astroport Lockdrop, as well as ongoing Astroport rewards. Secondly we have been using 20% of our vault revenues to accumulate Astro tokens for the last several months enabling the Warchest to accumulate over 1.275m Astro tokens so far.

The next big step will be the launch of our “Convex Model” on Terra, which is now nearly complete. You can find more detail here: https://articles.apollo.farm/apollo-dao-roadmap-and-development-insight/, under “7. Convex Model on Terra”.

One of the most exciting potentials of the model (beyond being able to boost the yields of Apollo vaults), is that it adds a completely new way to bootstrap the Warchest. Convex has managed to accumulate over $320m of CRV through this model, even if Apollo is able to accomplish 10% of this, this would more than triple the current value of the Apollo Warchest.

As mentioned at the top of this section, these are forward looking statements but are designed to shed some light on some of the future ways the Warchest will be able to continue to grow in value.

Warchest vs Fee Distribution

The final section in the post will cover why Apollo DAO has opted to go with a Warchest, over fee distribution to our token holders or stakers.

There are a number of reasons behind our decision to go with the Warchest design:

1. Long term mindset of Apollo DAO.

It is still very early days for both the Terra Ecosystem and Apollo DAO, however our aim is to build a DAO that has the capability of lasting indefinitely, and this viewpoint has shaped how we have built Apollo so far, such as owning $3m in Apollo LP, with plans to grow this further, as this will enable efficient trading of Apollo, even after the end of Astro rewards in 69 years.

In terms of the Warchest, by accruing value to it now during the Apollo distribution (Inflationary) Phase, even after Apollo rewards have ended, yield on Warchest assets can be paid to Apollo stakers or used to purchase Apollo tokens, taking them out of supply. This is also the reason for our focus on accumulating revenue generating assets that have the ability to generate sustainable revenue, even after token rewards have ended.

2. Accumulation of symbiotic protocol tokens.

The Warchests’ focus has not only been on accumulating revenue generating assets, but also ones that can benefit our products. Astro tokens are a perfect example of this, once vxAstro is released, it will give Apollo DAO the ability to:

- Sustain or increase Astro rewards for Apollo-UST LP by voting

- Vote on governance proposals, such as listing of new LPs

- Boost our vaults through "Boosties"

This however is just one token within the Apollo Warchest and we believe meta governance will become increasingly important to the Terra Ecosystem as it grows.

3. Without a Warchest, Apollo would be very reliant on external LP rewards and would need to continually increase TVL or fees in order to maintain the same staking rewards.

If all revenues from fees were paid out to stakers, then ongoing rewards to veApollo stakers would be highly dependent on APRs from external pools (ANC, MINE, MIR etc.), which tend to decrease and end over time. By accruing value in the Warchest, especially when rewards are higher, it enables Apollo to build a longer term and more sustainable reward model for its stakers through the Warchest yield.

4. Balance Apollo inflation.

One of the main aims of the Warchest is to continue to gain value during the inflationary phase of Apollo, so while there will be more Apollo circulating over time, this will be balanced by the continued increase in assets of the Warchest. The Warchest will be governed and deployed by veApollo stakers and could also be used to purchase Apollo off the market if the token becomes undervalued compared to the Warchest value. Apollo has relatively constant emissions for the first year and a half, with lower emissions (around 50% less) for the second year and half. This means in percentage terms, Apollo inflation is dramatically decreasing over time, as more Apollo is circulating. Over the last 5 months, the Apollo supply has increased by just over 300%, whereas it will now take almost 18 months for the same inflation percentage. This means over time it will become easier for the Warchest value to keep up with Apollo inflation.

So far the Warchest value has been catching up with the Apollo marketcap, despite this inflation, with the Warchest now holding assets valued at nearly 60% of the Apollo marketcap.

5. Value accrual

The Apollo platform has generated around $4.2m in performance fees, however the Warchest is now worth roughly $9.8m, meaning that by holding, staking and farming with the Warchest assets, we have been able to increase their value by over 130%. This means that over time Apollo DAO will be able to return more value to veApollo stakers.

Conclusion

Overall since the launch of the Apollo Warchest, we have managed to consistently grow the value, while diversified the Warchest holdings and focused on accumulating revenue generating assets. While the dollar value of the Apollo Warchest may not always grow (especially considering the volatility of both the crypto market and current the general macroeconomic market), we will constantly be accumulating more assets that we believe in long term and that will provide sustainable revenue to Apollo DAO. As demonstrated by the price action of Astroport, suppressed crypto prices often provide a great long term opportunity.

The next big step for the Apollo Warchest will be the launch of veApollo staking and governance. The Warchest will become increasingly decentralized over time and will allow Apollo DAO to be able to access far more opportunities. This is just the start for Apollo DAO and the Warchest and we are very excited to see the ideas and opportunities that our community chooses to deploy assets into.

If you have any questions or thoughts on this, you can join our social channels from the links below:

Join our Discord

Join our Telegram

Follow us on Twitter