The Apollo xAstro Lockdrop

We recently released our post on how Apollo's Convex model will work, the benefits it will offer and how our primary focus will be on maintaining the apAstro (zxvAstro-xAstro LP) peg, while providing a high yield to users who stake Astro with Apollo.

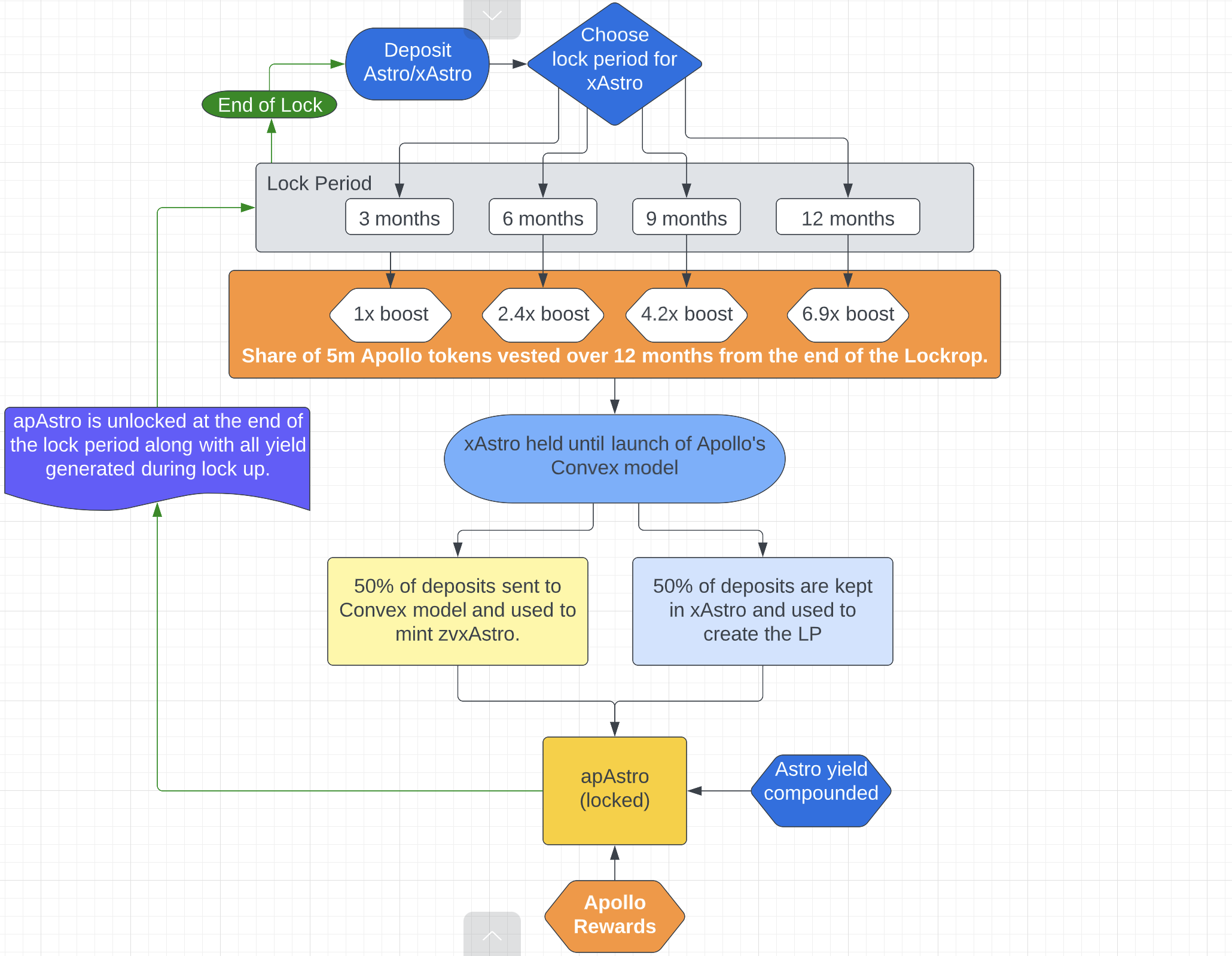

To kick off our Convex model, Apollo will be holding a Lockdrop where users can lock up Astro/xAstro for a period of time to receive bonus Apollo tokens linearly from the end of the Lockdrop. After the lock period ends, depositors will be able to claim their Astro deposit, plus all the accrued yield.

xAstro Lockdrop Overview:

- Launching on the 2nd of May (next Monday), with deposits open for 5 days

- Deposit and lock up Astro/xAstro for between 3 and 12 months

- 5 million Apollo tokens (5% of total supply) shared among depositors

- Apollo tokens vested linearly over 12 months

- Receive bonus Apollo tokens linearly from the end of the Lockdrop and then receive your Astro deposit, plus all the accrued yield at the end of your lock period.

How the xAstro Lockdrop will work

Apollo’s xAstro Lockdrop will commence on the 2nd of May and will conclude on the 8th of May.

Our Lockdrop will follow a similar format to previous Lockdrops from Delphi and Kinetic, but with only 1 Phase. Users will have 5 days to deposit and lock up Astro/xAstro and then will have 2 days where they can partially withdraw funds after deposits have been closed.

xAstro depositors will be able to choose to lock up their xAstro for between 3 and 12 months, with boosted Apollo rewards going to those who lock for longer.

In return, xAstro depositors will get a share of 5m Apollo tokens that will be linearly vested over 1 year and then at the end of their lock period, depositors will be able to unlock their apAstro, which will have auto compounded all of the Astro yield from the vault and claim their Apollo yield.

This means that users who deposit their xAstro with Apollo will be rewarded with:

- Share of 5 million Apollo tokens (5% of total supply)

- Liquid apAstro when their lock period ends (can be traded for xAstro or held for continued rewards)

- All the yield from their deposited Astro

The deposited xAstro will be held until the launch of vxAstro and Apollo’s Convex model. At this point 50% of the xAstro will be used to mint zvxAstro (sent to the Convex contract) and paired with the xAstro to create the initial liquidity. Depositors would then get locked apAstro, which will compound all Astro and accumulate Apollo rewards until it unlocks.

The apAstro yield will come from:

- All the rewards from the max locked vxAstro

- xAstro Rewards

- LP/trading fees

- (Potentially additional Astro LP rewards)

- On-going Apollo Rewards

With this Convex Model, Apollo will be able to utilise the Astro governance to vote for the zvxAstro-xAstro LP to receive ongoing Astro rewards and also boost this pool. This could provide significantly more Astro rewards to apAstro holders and would offer a significant benefit to focusing all rewards on the LP pool.

Why would users lock up their Astro with Apollo, rather than locking it up for vxAstro?

In order to maintain the maximum yield and boost from vxAstro, you have to continually max lock it and if you want to withdraw it, you would have 2 years of gradually lowering yields before you get it back. You also need to be farming with your own LPs directly in Astroport, rather than making use of auto compounding platforms, such as Apollo. This may not suit all users who are looking to get a high yield on their Astro tokens.

With Apollo’s Lockdrop, not only will you get additional Apollo tokens vested over 1 year; but at the end of your lock up period, you will get the full value of your Astro back in a liquid token, plus all the yield from your lock up period including the Apollo rewards and Astro which would have been auto compounded into the apAstro.

The Apollo tokens that you receive from the Lockdrop will have governance power over all of the Astro, as well as other tokens in the Apollo Warchest.

The xAstro Lockdrop Process

- Deposit Astro/xAstro and choose Lock Period,

- Receive bonus Apollo vested over 1 year from the end of the Lockdrop,

- xAstro will be held, accruing yield until launch of vxAstro and Apollo's Convex model,

- xAstro used to create apAstro (zvxAstro-xAstro LP),

- Astro yield compounded in apAstro, plus additional on-going Apollo rewards,

- End of your Lock Period, you will receive all of your Astro back, plus any yield from apAstro over that time, as well as the bonus Apollo tokens that have been vesting.

Why this Lockdrop is also beneficial to Apollo

The aim of this Lockdrop is to increase Apollo's Astro gvoernance power. 50% of the xAstro that is deposited into this Lockdrop will be sent to the Apollo Warchest and used to mint zvxAstro in return. While the yield will be directed to apAstro holders, this will be a big boost in Warchest assets, offsetting the Apollo inflation from the lockdrop. In return for this, Apollo’s focus will be on maintaining the apAstro (zvxAstro-xAstro LP) peg, so that users can enter and exit Apollo’s apAstro vault with minimum slippage, ensuring they are constantly liquid, while also providing a great yield.

One of the main long term benefit to Apollo DAO will be the ability to boost the Astro yields on our LP vaults, offering our users increased yields on their positions, which also generating increased fees for the Apollo Warchest.

The Apollo tokens for this Lockdrop will come from Apollo’s farming rewards. We cut down our farming emissions a number of weeks ago, in order to ensure there were enough Apollo farming rewards to support our Convex model long term.

Why would you lock your xAstro up with Apollo, rather than other options?

Apollo DAO has been live for nearly 6 months. In that time we have delivered a number of DeFi products from our Vaults to Safe and have bootstrapped over $13m for our Warchest. It is still very early days for Apollo, with a number of additional features from leveraged yield farming to veApollo staking and our Convex model all due for release shortly. This provides a very solid base for Apollo to be offering a Lockdrop, aimed at enhancing our current offering, while also focusing on not diluting our current holders.

The main benefits for Astro/xAstro depositors with Apollo are:

- Apollo’s main focus with our Convex model is delivering a high yield, while maintaining the peg (between zvxAstro-xAstro), to ensure that apAstro holders will always be able to exit their position with minimum slippage. You can learn more about the ways in which we will be maintaining the peg, from our recent Convex post. However if you are planning to deposit your Astro into a Convex model Lockdrop, you need to be confident that the peg will be maintained long term.

- All Astro rewards that are directed to the apAstro vault will be auto compounded into your position throughout the lock-up period. This means that your Astro balance will continue to increase during your lock period and at the end you will be able to claim all of your deposited Astro back, as well as the additional yield from that period.

- Apollo-UST currently has ~$15m in liquidity and several months of trading history, which provides a more solid floor for the Apollo token. We are also already generating several million in revenues per year from our vaults, as well as from the yield from our Warchest assets.

- Apollo has already bootstrapped our Warchest with ~$13m in assets and with the release of veApollo, we will be bringing a lot more utility to the Apollo token. Apollo’s current DeFi products and Warchest will continue to earn revenues and means that Apollo tokens will have value outside of our Convex model alone.

- By providing boosted Apollo returns for those who lock up their Astro for longer, we will be able to increase the stability of our Convex model. This is because the largest threat to maintaining the peg is a large exodus in a short period of time. We will not only avoid this with a range of lock up times, but will also have more time to strengthen the peg and deepen liquidity before unlocks begin.

Conclusion

Our xAstro Lockdrop is just the start of our Convex model. As stated at the beginning, our two objectives are to maintain the peg and provide a high yield, long term on our apAstro vault. Therefore we will be focusing more on our on-going Apollo rewards on maintaining a higher APY on our apAstro vault long term, rather than focusing too many Apollo rewards on the Lockdrop alone. This is due to the fact that if rewards are too high early on, this can attract a large amount of Astro liquidity, however if these rewards then drop (in amount or price), it can cause a mass exodus from the Convex model, making it extremely difficult to consistently maintain the peg.

The design of our Lockdrop has also focused heavily on not diluting our current holders and is the reason for the 1 year vesting, which will ensure that there is no sudden supply shock of Apollo tokens.

By not diluting our current holders with this Lockdrop, while also increasing the value of the Apollo Warchest, it will increase the long term stability of both Apollo DAO and our Convex model. Apollo’s aim with our Convex model is not to just attract large amounts of Astro liquidity upfront, but to ensure we can provide a long term solution allowing users to gain a high yield on their Astro tokens, while always remaining liquid and benefiting Apollo Vaults with increased yield.

Join our Discord

Join our Telegram

Follow us on Twitter